Advertisement

Advertisement

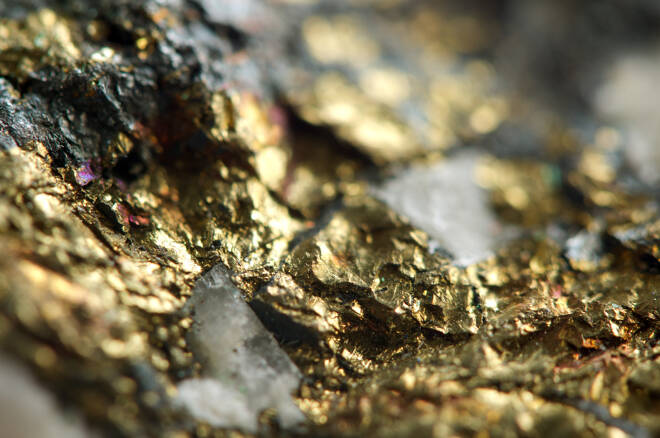

Gold Price Forecast – Gold Markets Pulled Back Slightly

Updated: Nov 21, 2019, 16:48 GMT+00:00

Gold markets pulled back slightly during the trading session on Thursday, showing signs of continued digest and of the longer-term gains. At this point, it looks as if the gold market is trying to build some type of base.

Gold markets pulled back slightly during the trading session on Thursday, as we continue to see a lot of noise just above the crucial $1450 level. That’s an area that had previously shown signs of resistance, and now “market memory” could come into play, offering plenty of buying pressure. After all, the market has already bounce from there and did so forming a hammer about a week and ½ ago. Beyond that, we have pulled back a bit a couple of times and in general has formed a couple of hammers as well. That being said, it’s very likely that the market will continue to find buyers underneath. However, it doesn’t necessarily mean that we are going to shoot straight up in the air.

Gold Technical Analysis Video 22.11.19

Looking at the short term analysis, the 50 day EMA is closer to the $1486 level that could cause some issues, and if we can break above there it’s likely that the market will go looking towards the psychologically and structurally important $1500 level. Clearing that level is a very good sign and should have traders coming into the fold and taken advantage of potential momentum at that point in time. By then, it should be relatively obvious that the buyers are taking control again, and quite frankly with the US/China trade situation all over the place as it has been, it wouldn’t take much to have people scared into buying gold yet again. As far as selling is concerned, I have no interest in doing so until we break down below the 200 day EMA which is further below.

Please let us know what you think in the comments below

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement