Advertisement

Advertisement

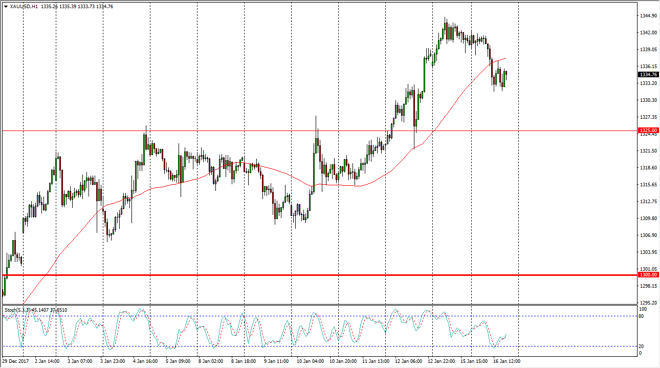

Gold Price Forecast January 17, 2018, Technical Analysis

Updated: Jan 17, 2018, 08:06 GMT+00:00

Gold markets went sideways initially during the trading session on Tuesday, and then drifted lower as we reached towards the $1330 level. Beyond that, I see even more support just below.

Gold markets pulled back slightly during the Tuesday session as traders came back from the Martin Luther King Jr. holiday. Ultimately, I believe that the $1325 level is an area where you would expect to see a lot of support based upon previous resistance, and of course a massive candle on the hourly chart from a couple of sessions ago. I believe that the $1350 level above is significant resistance, but I also believe that we will eventually break above there. I believe in buying on the dips, and I also believe in adding slowly as the volatility in the precious metals markets will almost undoubtedly pick up.

The markets continue to be an opportunity just waiting to happen, as the US dollar in general has been beaten up. During the Tuesday session, the US dollar did rally a bit, and that’s part of what’s causing this pullback. However, when you look at the longer-term charts it’s obvious that the US dollar has started 2018 on the back foot. If that continues to be the case, gold and silver both will offer opportunities.

Once we get above the $1350 level, the market then goes to the $1375 level next. I believe that there is a major resistance barrier at the $1400 level, and if we can break above there, the market should continue to go much higher, perhaps changing the overall long-term trend as well, sending this market looking for levels as high as $2000 over the next several months, if not years. This will coincide with the US dollar falling against other currencies around the world.

Gold Outlook Video 17.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement