Advertisement

Advertisement

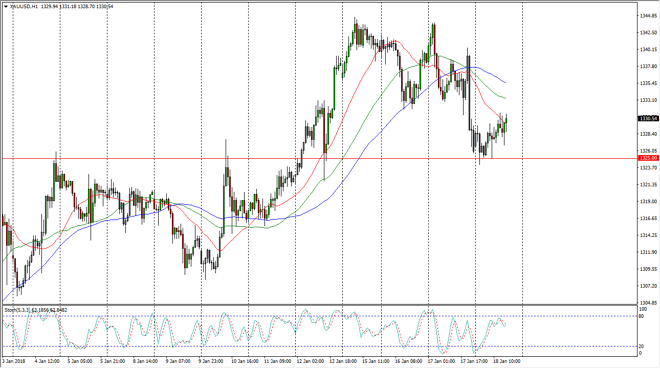

Gold Price Forecast January 19, 2018, Technical Analysis

Updated: Jan 19, 2018, 05:47 GMT+00:00

Gold markets rallied slightly during the trading session on Thursday, showing signs of life again. The $1325 level has offered support, but given enough time I think that there will be volatility that you can take advantage of.

Gold markets rallied slightly during the trading session on Thursday, after using the $1325 level as support. I think this makes a lot of sense, because the area was previous resistance, so we should see buyers in this area. Gold also should continue to benefit from a softer US dollar, assuming that trend continues. There are other reasons alike although, not the least of which will be geopolitical tensions around the world. Don’t forget that the gold markets tend to be sensitive to risk appetite and of course the safety trade.

If we do break down below the $1325 level, I think there is more than enough support below to eventually find a trade to the upside. I don’t have any interest in shorting this market, least not until we would break down below the $1300 level, which was previous resistance in the past. I think that longer-term though, it will be seen as the beginning of a much larger break out. Because of this, I remain bullish, but also recognize that the noise can be very difficult for short-term traders to deal with.

Using dips along the way on short-term charts continues to be the best way to trade gold from what I see, and although I expected to be very noisy, I also expect that eventually we will see gold reach towards the $1400 level, which is a longer-term resistance area that being cleared would be a huge signal for buyers. Pay attention to the US Dollar Index, if it continues to fall, that should help gold as well.

Price of Gold Video 19.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement