Advertisement

Advertisement

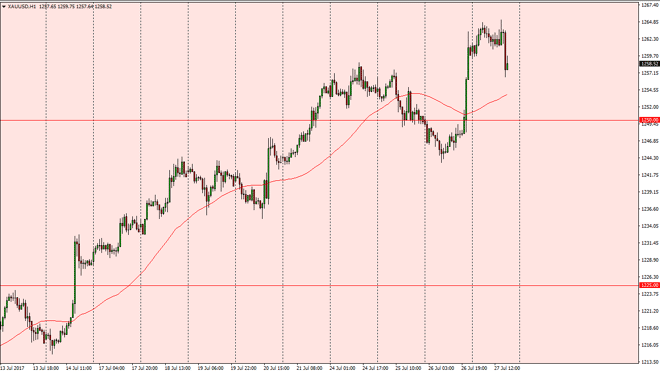

Gold Price Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:58 GMT+00:00

Gold markets went sideways initially during the day on Thursday, and then fell rather significantly in a sudden downdraft. This looks a lot like

Gold markets went sideways initially during the day on Thursday, and then fell rather significantly in a sudden downdraft. This looks a lot like profit-taking, so we will have to see what happens next. I believe there is plenty of support down to at least the $1250 level, so as soon as we get a supportive candle or a bounce, I am willing to buy. It’s not until we break down below the $1240 level that I would be willing to start selling. Yes, I recognize that there is a lot of negativity in the market suddenly, but at the end of the day it is yet a blip on the radar of the overall uptrend.

Buying dips

I need to see a supportive candle underneath to start buying again, but that is my plan right now, to buy dips as they occur. I believe that the gold markets will probably go towards the $1275 level over the longer term, and then eventually the $1300 level after that. I have no interest in shorting until we break down below the previously mentioned $1240 level, so now it’s a simple waiting game for me when it comes to the gold market. I believe that the US dollar rallied has been a major contributor to the massive pullback that we have seen, but at this point I think that it’s only a matter of time before traders start shorting the US dollar again, and picking up gold. Patients will be needed, but that apparent trade should show itself yet again.

Gold Price Predictions Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement