Advertisement

Advertisement

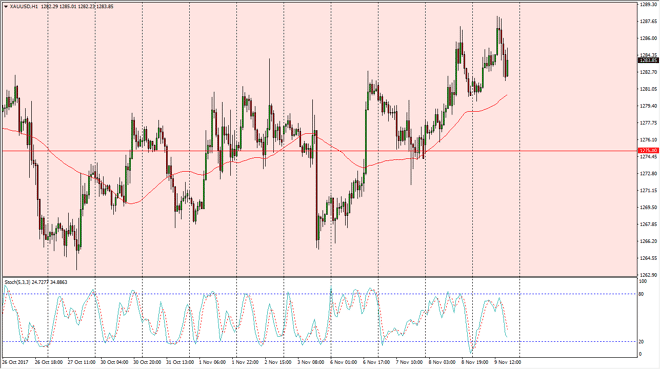

Gold Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:34 GMT+00:00

Gold markets initially rallied on Thursday, reaching as high as $1290. However, we have rolled over a bit later in the day, and it looks as if we are

Gold markets initially rallied on Thursday, reaching as high as $1290. However, we have rolled over a bit later in the day, and it looks as if we are trying to show signs of exhaustion yet again. I recognize that the $1300 level above is massive resistance, and therefore would not surprise me at all if the market roles over from here. However, I don’t have a cell signal quite yet, and therefore I am going to sit on the sidelines and wait for some type of exhaustion above that I consider selling. I think that somewhere close to the $1300 level we will see an increase in bearish pressure, as it has held so steadfastly over the multiple attempts at a break above there for any length of time.

The US dollar looks as if it is ready to rally against several other currencies around the world, and that typically works against the value of gold. It doesn’t mean that that correlation has to sit still and always be the same, but it is yet another reason to think the gold may not be able to hang on the gains. Ultimately, I think the $1275 level is essentially the middle point of the range that we are trading and right now, so as we have gotten a bit far from there, it would make sense for the market to reach back towards that level yet again. That’s an area where traders seem to be very comfortable with gold, and quite frankly that is typically what you see as a magnet for price. If we were to break above the $1300 level, it would take a daily close above that level to get me to start thinking about buying, as I see far too much in the way of resistance between here and there.

Gold Price Predictions Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement