Advertisement

Advertisement

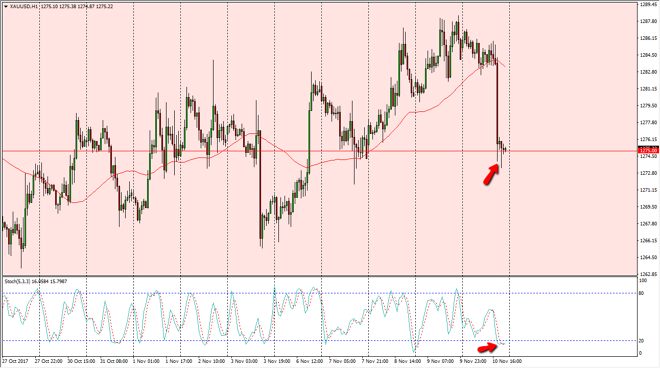

Gold Price Forecast November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:08 GMT+00:00

Gold markets were choppy in the beginning of the session on Friday, but then collapsed and fell towards the $1275 level underneath. We are starting to

Gold markets were choppy in the beginning of the session on Friday, but then collapsed and fell towards the $1275 level underneath. We are starting to form a little bit of supportive action on the hourly chart, mainly in the form of the hammer, and of course the stochastic oscillator crossing to the upside in the oversold condition. This tells me that the market is probably ready to rally from here, and therefore are willing to buy gold at the $1277 level. A break above there could send this market towards the $1287 level next. I am think that if we can stay above the $1275 level, the market should remain rather bullish. However, if we were to break down below the $1272 level, the market probably drops down to the $1265 level.

When looking at the longer-term charts, I cannot help but notice that there is a bit of an upward channel that has been forming during the entirety of 2017. I think that we will continue to find reasons for going to go higher, perhaps due to geopolitical concerns. In general, I do like gold, but I recognize that it tends to be rather volatile. Once we do finally get a breakout above the $1300 level that holds, we should continue to go much higher. For longer-term traders, the short-term pullbacks have been buying opportunities and short-term traders can take advantage of that as well, as we know that the longer-term traders are willing to throw money at the market. In general, I do not like shorting, but I do recognize that occasionally these pullbacks can be taken advantage of for short selling. I believe that given enough time, buyers will return so therefore I am much more aggressive to the upside than the downside.

Gold Prices Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement