Advertisement

Advertisement

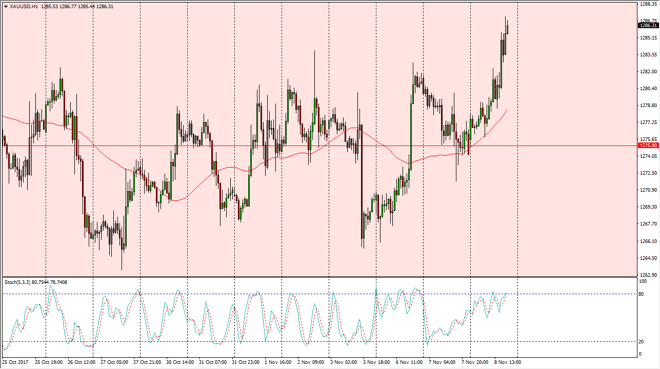

Gold Price Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 05:21 GMT+00:00

The gold market rallied significantly during the trading session on Wednesday, reaching towards the $1285 level. On the stochastic oscillator, we are

The gold market rallied significantly during the trading session on Wednesday, reaching towards the $1285 level. On the stochastic oscillator, we are starting to try and cross over and the overbought area, and it’s likely that the area between here and $1300 will continue to cause issues. Although the hourly chart looks very healthy, we are bit overextended, and when you look at the longer-term charts, the $1300 level has been massively resistive. I believe that there is a strong barrier at that area, and with the greenback strengthening in general, I think gold will continue to struggle. However, if we get some type of geopolitical issue, gold could rally in a bit of a “panic.” If that happens, I will wait for things to calm down and start shorting, especially if we cannot break above the $1300 level.

Alternately, if we break above the $1300 level on a daily close, then I would be a buyer as the market should then go to the $1325 level above. I recognize that the $1275 level has been a bit of a magnet for price, and I believe that the market will continue to hunt that level out as long as nothing changes fundamentally. Right now, I think that the market has gotten a bit ahead of itself, and the fact that we are starting to see long wicks on the hourly chart tells me that a breakout above $1300 is very unlikely as well. With this being the case, and the proclivity of the market to favor the US dollar, I feel that this is going to end up being and I selling opportunity, and the nice part is that we have an obvious place to put a stop loss, just above the $1300 handle.

Gold Price Forecast Video 09.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement