Advertisement

Advertisement

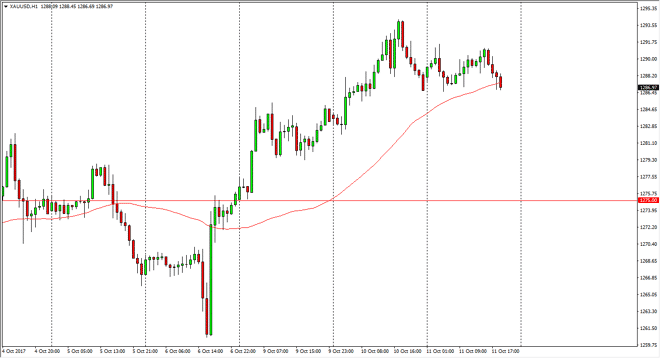

Gold Price Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:54 GMT+00:00

Gold markets initially went sideways on Wednesday, but did drop a little bit as we started reach towards the end of the day. I think that it’s only a

Gold markets initially went sideways on Wednesday, but did drop a little bit as we started reach towards the end of the day. I think that it’s only a matter of time before the buyers return though, unless of course the FOMC ends up being very hawkish, which would be positive for the US dollar. That does way upon precious metals in general, so having said that it’s likely that we should get a significant move. The $1275 level underneath should be supportive, and essentially the “floor.” If we were to break down below that level, then I think gold markets will come unraveled. That being the case, the market should continue to attract a lot of attention, especially we do pull back. In fact, if we can find stability near the $1275 level, it could be a nice buying opportunity. Alternately, a break above the $1300 level would be a massively bullish sign, and should extend this market much higher.

Remember that the US dollar is highly influential as to where gold markets go next, as it is essentially a bit of an inverse to the greenback. If we did break above the $1300 level, the market probably goes looking towards the $1325 level, and then eventually the $1350 level. Ultimately, this is a market that continues to see quite a bit of volatility, but I believe that we should get an opportunity to take advantage of what could be a longer-term move. However, if the Federal Reserve becomes much more hawkish than people had anticipated, that could be the end of this rally. The next 24 hours are going to be very important for the future of the gold markets, and therefore I think that the next impulsive move will be rather important.

Gold Price Forecast Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement