Advertisement

Advertisement

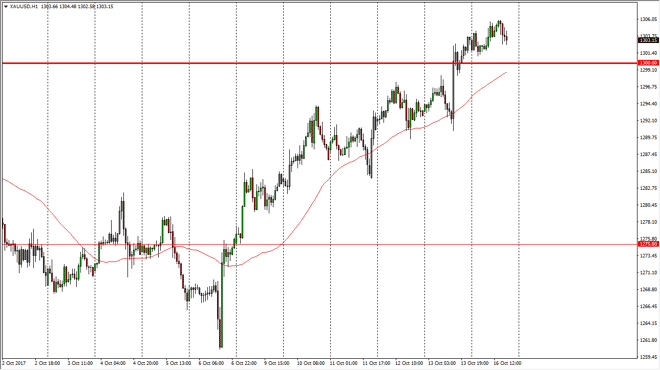

Gold Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:02 GMT+00:00

Gold markets have shown a bit of strength during the Monday session, as we continue to hang above the $1300 level. That is a very bullish sign, and as you

Gold markets have shown a bit of strength during the Monday session, as we continue to hang above the $1300 level. That is a very bullish sign, and as you can see we can already look at the 24-hour exponential moving average as dynamic support as well. It is just below the $1300 level, so I think that pullbacks towards that area will continue to attract interest. I think that the gold markets breaking above the $1300 level is a very bullish sign, and that it should continue to send money into this market place going forward. I think that the $1325 level above is the next target, and I believe that it’s a matter of time before the buyers return on these pullbacks as they represent value.

Safety bid

Just as I said in the Silver markets, you get a certain amount of safety bid in the gold market. Recently, this meant North Korea, but quite frankly that is starting to have less of an effect on pricing. However, there are many other things out there that could rattle the markets, and that should help gold. Pay attention to the value of the US dollar, because it has a directly negative correlation to gold most of the time. If the US dollar continues to fall overall, that should continue to put upward pressure on the gold market. Overall, I am bullish of gold, as we have seen stair stepping lately. I think that these pullbacks will continue to be an opportunity to pick up a little bit of the market going forward, and I don’t have any interest in shorting this market until we break down below the $1290 level. Even then, I would be a bit cautious as there is so much volatility.

Gold Analysis Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement