Advertisement

Advertisement

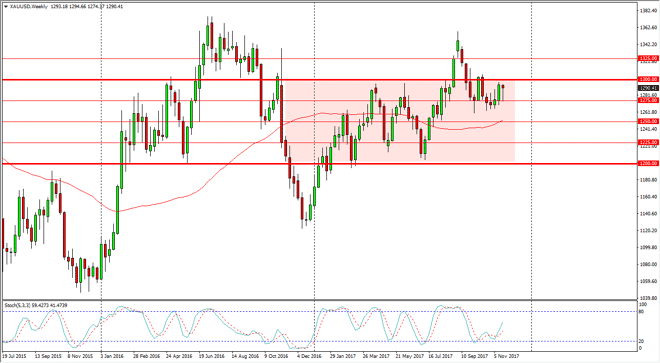

Gold Price forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 25, 2017, 05:22 GMT+00:00

Gold markets initially fell during the bulk of the week, but turned around to form a massive hammer starting at the $1275 level. By turning around and

Gold markets initially fell during the bulk of the week, but turned around to form a massive hammer starting at the $1275 level. By turning around and forming a hammer, it suggests that the market is trying to build up enough pressure to go to the upside, with an eye on the $1300 level above. If we can break above that level, the market should continue to go much higher, perhaps reaching towards the $1325 level next, and then eventually the $1350 level after that. Pullbacks continue to be buying opportunities, if we can stay above the $1275 level. Alternately, a breakdown below there should send this market to the $1250 level next, which is “fair value” for the year. The pattern that we are starting to form is a bit of a “U” shape, which suggests that perhaps we are trying to form enough momentum to go to the upside.

Longer-term, the market should go looking towards the $1400 level above but it’s going to take some type of momentum to finally break out. I think longer-term “buy-and-hold” traders have the right idea, as we have formed a nice uptrend in channel for some time, and that it’s likely to signify that we will eventually get that moved to the upside. However, with a lot of leverage on your position you could find yourself in a lot of trouble. The volatility in gold will continue to keep leverage on the back burner, but the longer-term traders have done quite well in this scenario. By keeping your leverage low, or even not at all, you should continue to benefit from what has been a gradual grind higher, and of course with the U.S. Congress being unable to pass tax reform of significance, that should continue to push this market to the upside.

Gold Price Predictions Video 27.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement