Advertisement

Advertisement

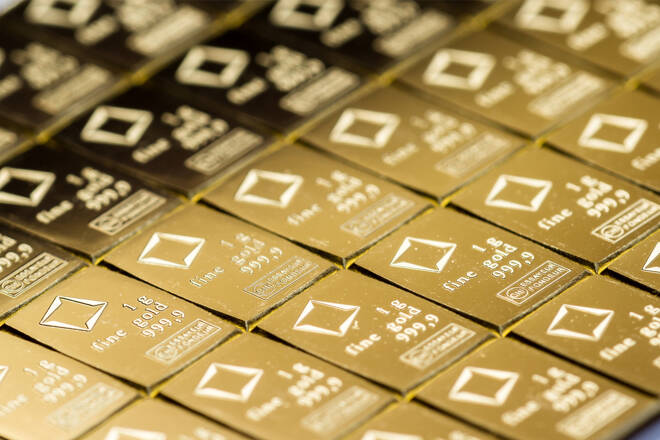

Gold Records Best Month In 3 Years – But Will The Rally Continue?

By:

Gold prices are not only heading for their biggest monthly return since July 2020, but also their second straight quarterly rise in a row.

Gold’s Unstoppable Rally: What’s Driving Prices and What’s Next for Investors?

There is no denying that Gold is everyone’s favourite trade once again and that trend is set to continue throughout the rest of 2023 – amid growing risk of further banking turmoil, a looming credit crunch and rising hopes of a Fed pivot.

The precious metal has been on an unstoppable run, rallying from the $1,800 level at the beginning of March to above $2,000 an ounce – not once, twice but three times this month – notching up an impressive gain of over 10%, its biggest monthly gain on record.

Since the final quarter of 2022, Gold prices have gone parabolic rallying over $400 an ounce from their November lows of $1,600.

The bullish momentum has also split over into Gold priced in other currencies such as British Pounds, Euros and Australian Dollars – sending prices skyrocketing to all-time record highs.

And this could just be the beginning!

A few weeks ago economists were convinced the global economy was powering ahead. Now they predict a deep recession is on the way – as a domino effect of the collapse of several prominent banks from Silicon Valley Bank to Signature Bank as well as the disorderly implosion of Credit Suisse.

Banking crises are almost never resolved in weeks or months. The consequences can last for years, if not decades triggering a sequence of events along the way. This has traders convinced that recent events, are merely just the tip of the iceberg.

Conclusive evidence shows the global banking crisis was fuelled as a direct consequence of soaring interest rates and liquidity risks. But this crisis is now about to get even bigger as it rapidly morphs into a “Global Credit Crunch”.

Crisis Breeds Opportunity: The Rise of Precious Metals

Right now we have crisis on top of crisis, which as traders know – translates to opportunity on top of opportunity. While Precious metals certainly don’t need a crisis to move higher, they definitely love a crisis!

Whichever way you look at it, one thing is clear – it’s only a matter of time before Gold prices break above $2,000 an ounce. The big question now is how high will prices go?

Commodity Price Forecast for March 31, 2023

Where are prices heading next? Watch The Commodity Report now, for my latest price forecasts and predictions:

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Phil Carrcontributor

Phil Carr is co-founder and the Head of Trading at The Gold & Silver Club, an international Commodities Trading, Research and Data-Intelligence firm.

Advertisement