Advertisement

Advertisement

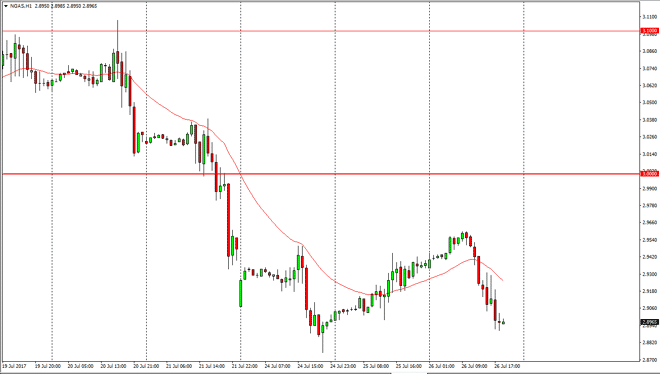

Natural Gas Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:41 GMT+00:00

Natural gas markets initially tried to rally during the Wednesday session but fell apart as the $2.95 level seem to be a bit too rich for traders to hang

Natural gas markets initially tried to rally during the Wednesday session but fell apart as the $2.95 level seem to be a bit too rich for traders to hang onto. Because of this, I believe that we will continue to see selling pressure, and it’s only a matter of time before we make a fresh, new low. The $2.85 level underneath should be supportive, and I think that if we can break down below there it opens the door to the $2.75 level underneath, which is very supportive as well. Overall though, I think that the oversupply of natural gas will continue to weigh upon this market, and with that being the case it’s likely that we will continue to see sellers jump into this market on short-term rallies that show the slightest bit of resistance.

Selling rallies

Because of that analysis, I continue to sell rallies, and as you can see it has worked several times in the past. If we break down below the $2.75 level, the market should then go looking for the $2.50 level below, which I think is even more important. I have no interest in buying, and I recognize that there is a massive resistance barrier between the $3.00 level above, extending to the $3.10 level. I believe that natural gas will continue to be a market that can be sold from time to time, but keep your leverage a bit low, because this market does tend to be very volatile, so we can rip right in your face occasionally. I still believe in the downside regardless of what happens, so given enough time I will be a seller no matter what happens.

NATGAS Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement