Advertisement

Advertisement

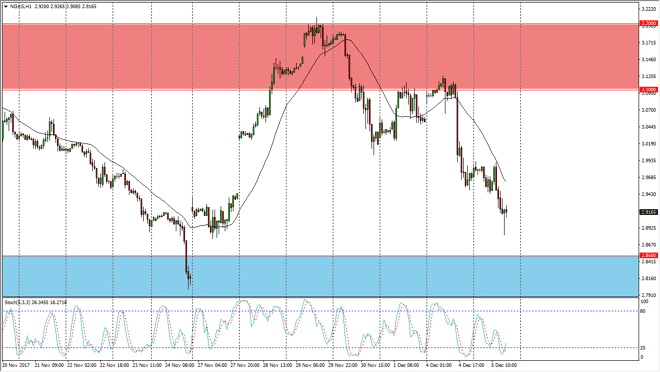

Natural Gas Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 06:57 GMT+00:00

The natural gas markets have been slightly negative, as we continue to grind lower during Tuesday trading. However, we are getting close to that area below that has been very supportive.

Looking at the natural gas markets, we have seen a roll over during the trading session on Tuesday, reaching down towards the $2.85 level below, which is a massive support region. This is an area that continues to attract a lot of attention, and the fact that we have rolled over so drastically during the last 4 or 5 sessions tells me that we are probably due for a bounce. On the hourly chart, we are starting to see a cross over in the oversold part of the Stochastic Oscillator, so we should eventually continue to go back towards the upside, perhaps to the $3.10 level.

Seasonality does favor natural gas, as the northeastern part of the United States is getting colder temperatures. Typically, this time of year we will see buyers enter the market, and eventually we could get some type of spike to the upside. However, the overall attitude of markets will continue to be bearish longer-term, because we have far too much in the way of supply. In the meantime, I believe that we are going to continue to go back and forth, and therefore as we are close to the bottom of the region that we have been trading in, it’s probably an opportunity to start buying again. I would keep my position size small though, because the volatility has been horrific in the natural gas markets. In general, I am bearish, but I also recognize that we do get the short-term buying opportunities occasionally. If we were to break down below the $2.75 level, that would be a collapse of the market, just as a break above the $3.20 level would be the beginning of a major move higher.

NATGAS Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement