Advertisement

Advertisement

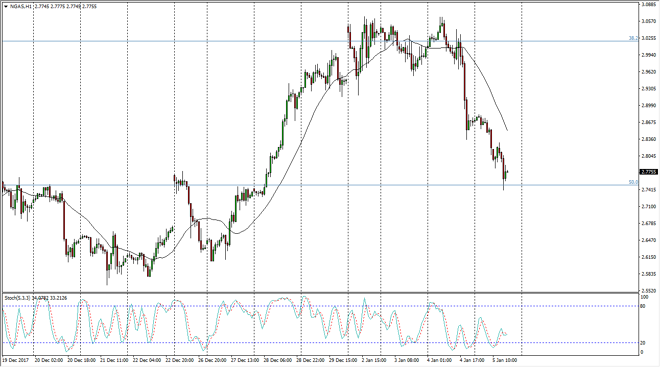

Natural Gas Price Forecast January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:46 GMT+00:00

Natural gas markets rolled over again during the trading session on Friday, testing the $2.75 level. That’s an area that has been important in the past, so it’s not a huge surprise that it could cause support again. I believe that this market continues to be very soft.

The natural gas markets rolled over again on Friday, initially in a very slow manner, but then accelerated later in the day. We have bounced from the $2.75 level underneath, which is an area that has acted as both support and resistance in the past, so it’s not a surprise that the bounce occurred. However, I think that any rally at this point is and I selling opportunity, as the natural gas markets have not been able to hang onto gains for some time, even in the bitterly cold weather in the northeastern part of the United States.

Because of this, wait for signs of exhaustion after short-term rallies to start selling. If we break down below the $2.74 level, the market probably goes down to the $2.65 level next. After that, the $2.6 level show signs of support as well. I think of selling rallies for short-term trades continues to be the best way to deal with this market, as not been able to hang onto gains in this type of weather tells you just how bearish the market truly is. Oversupply of natural gas around the world will continue to be an issue, and therefore continue to put a bearish pressure on this market. In fact, I don’t even have a scenario where I’m willing to buy this market for anything other than a quick term bounce, which at this point looks to be rather dangerous to attempt. The market should continue to be a straightforward “sell the rallies” affair.

NATGAS Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement