Advertisement

Advertisement

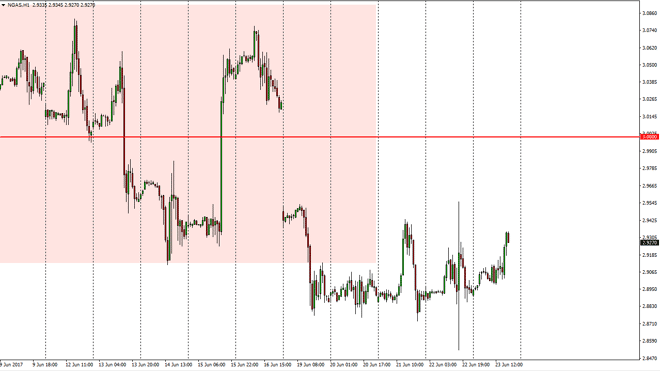

Natural Gas Price Forecast June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:12 GMT+00:00

Natural gas markets rallied again on Friday, but we continue to see sellers jump into this market every time it does. There is a big gap above, as Monday

Natural gas markets rallied again on Friday, but we continue to see sellers jump into this market every time it does. There is a big gap above, as Monday was so bearish. The $3 level above is massively resistive, and because of this I think that every time we rally, the sellers will get involved. I think that an exhaustive candle could be a nice opportunity to start selling, as we would then go down to the $2.87 level, and a breakdown below there could send this market down to the $2.75 level. There is a significant amount of bearish pressure and the natural gas markets, mainly because of the oversupply that we have seen for so long. Ultimately, this is a market that continues to suffer from a lack of demand as well. The oversupply of natural gas continues to be an issue as the United States has more than enough natural gas to not only power itself, but the rest of the world.

Selling rallies

I believe in selling rallies, as there is no fundamental reason to trying to think that were going to go higher for any real length of time. I also believe that the market reaching towards the $2.75 level will happen over the next couple of weeks and then we will eventually break down below there, perhaps testing the lows of the $2.50 level after that. I don’t have any interest whatsoever in buying because of the recent price action, and of course the longer-term outlook for the market is so poor. I don’t have any interest in trying to fight what I think is a secular issue, and therefore I express negativity every time I can. That doesn’t mean that is can be easy, but I think it will be much more difficult to try to start buying.

NATGAS Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement