Advertisement

Advertisement

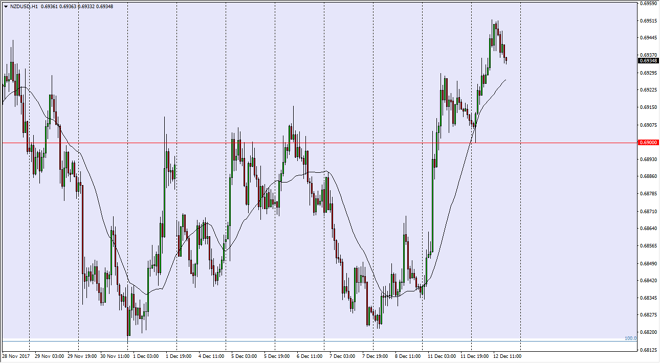

NZD/USD Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:11 GMT+00:00

The New Zealand dollar rallied significantly during the trading session on Tuesday, reaching as high as 0.6950. However, we have a Federal Reserve interest rate statement coming out today that will have a massive amount of influence.

The New Zealand dollar has a significant amount of support at the 0.69 level underneath, and therefore I think it will be a fight to get through there. I am still bearish of the New Zealand dollar though, because I believe that until we break above the 0.70 level, we are still very low in the overall consolidated move, and let us not forget that we had recently pulled back to the 100% Fibonacci retracement level from the previous rally. With the Federal Reserve having an interest rate statement coming out during the trading session today, it will be interesting to see how the market reacts to that statement. If it is a bit more dovish than anticipated, that will send the New Zealand dollar higher.

However, New Zealand has its own issues, so if the Federal Reserve sounds more hawkish than anticipated, that should send this market looking down to the 0.69 level, and perhaps even breaking down below there. If we break down below that level, then I think the market goes down to the 0.68 handle below which has been massive support. If we break down below there, then the bottom has just fallen out of the New Zealand dollar, and we can go much lower, perhaps as low as the 0.6350 level over the longer term. While I don’t know that’s going to happen today, I still favor the downside as a stronger than anticipated CPI number has killed over half of the rally that we had seen previously during the Tuesday session.

NZD/USD Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement