Advertisement

Advertisement

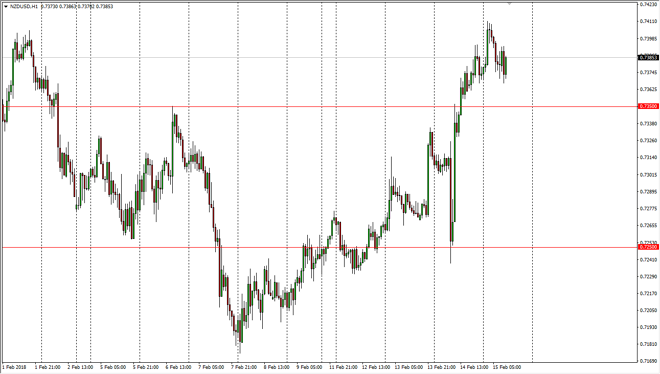

NZD/USD Price Forecast February 16, 2018, Technical Analysis

Updated: Feb 16, 2018, 05:23 GMT+00:00

The New Zealand dollar has been noisy during the trading session on Thursday, initially reaching towards the 0.74 level, but then pulled back to show signs of weakness later in the day. However, there’s even more important support just below, so I think we will continue to see bullish pressure, but noisy trading conditions to say the least.

The New Zealand dollar has risen over the last several days, but the Thursday session has been a little bit negative later in the day. There seems to be significant support at the 0.7350 level underneath, which was previously resistive. I think that the market could continue to go higher from here, perhaps reaching towards the 0.74 level, and then eventually the 0.75 level which is a large, round, psychologically significant number. If we can break above there, then the New Zealand dollar becomes more “buy-and-hold”, but we have a lot of work to do before we can accomplish that task.

In the meantime, I believe that the market should continue to find buyers on dips, so therefore I don’t have any interest in shorting, especially considering how soft the US dollar has been as of late, lifting commodities, and by extension the New Zealand dollar. The US bond markets are selling off, so in a run towards yield, I believe that people will continue to look to New Zealand for bond buying, and that should put upward pressure on the market as well.

Not to be outdone, keep in mind that this pair is a risk appetite proxy for currency markets, meaning that if risk appetite around the world climbs, this pair does as well. Of course, the opposite is true also, so keep an eye on the stock markets as well as the commodity markets.

NZD/USD Video 16.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement