Advertisement

Advertisement

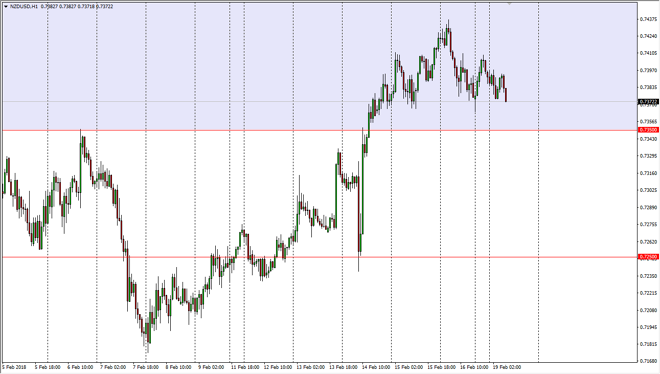

NZD/USD Price Forecast February 20, 2018, Technical Analysis

Updated: Feb 20, 2018, 05:22 GMT+00:00

The New Zealand dollar has drifted lower during early trading on Monday, as we continue to see a bit of a churn just above the 0.7350 level. Longer-term, we are in an uptrend though, so I think it’s only a matter of time before the buyers return.

The New Zealand dollar has been rolling over during most of early trading on Monday, but I see a significant amount of support near the 0.7350 level. Because of this, I’m waiting some type of bounce or supportive candle that I can take advantage of as the US dollar has been on its back foot for a while. I believe that any type of bounce from the 0.7350 level could bring 0.7425 into play again, and perhaps signal another attempt to reach towards the 0.75 level above.

If we can break down below the 0.7350 level, the market will more than likely go looking towards the 0.73 level, followed very quickly by the 0.7250 level. That’s an area that I think is even more supportive, so I feel that it is only a matter of time before the buyers return, unless of course we get some type of massive “risk off” type of event. If that’s the case, then of course the New Zealand dollar will get pummeled rather quickly, as it is quite common to see the New Zealand dollar suffering those times. I think that overall, we will eventually build up the necessary momentum to break above the important 0.75 level, but it’s going to take several attempts, so these pullbacks don’t necessarily surprise me in the least. I look at pullbacks as potential value and will continue to do so unless something changes fundamentally across the global landscape. On a break above 0.75, it becomes a “buy-and-hold” currency pair.

NZD/USD Video 20.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement