Advertisement

Advertisement

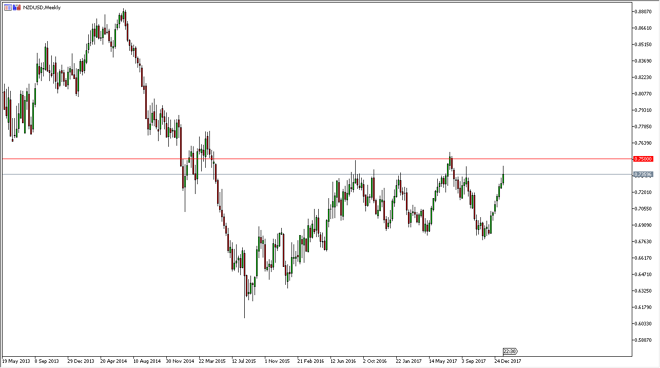

NZD/USD Price forecast for the week of January 29, 2018, Technical Analysis

Updated: Jan 27, 2018, 05:45 GMT+00:00

The New Zealand dollar has rallied a bit during the course of the week, breaking above the 0.74 level at one point, but has pulled back a bit as we continue to see selling pressure in this general vicinity. It’s not until we break above the 0.75 handle that I am willing to buy this market from a longer-term standpoint quite yet.

The New Zealand dollar continues to struggle above, and I think it’s only a matter of time before we roll over. We are overextended, so I think that the rollover is necessary, even though I do believe that eventually the US dollar falls. Market participants continue to be choppy overall, and I believe that the market could stay within the consolidation area, and I think that the market being overbought is a very real possibility this point. It’s not until we break above the 0.75 level that I would look at this as a market that should show very positive momentum.

As far as selling is concerned, I would be cautious about doing so, but would not surprise me at all to see this market turn around. Ultimately, I think that the New Zealand dollar is a bit overdone, so I think if nothing else we will revert to the mean. When I look at this pair, I think that the 0.68 level underneath is massive support. I would keep my position a bit small, because this market does tend to move rather rapidly, keep in mind that the commodity markets also have a direct influence on this market also. Pay attention to the soft commodities, such as grains, as it tends to have a direct influence. There is a lot of noise just above, I think it’s going to take several attempts to finally break out.

NZD/USD Video 29.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement