Advertisement

Advertisement

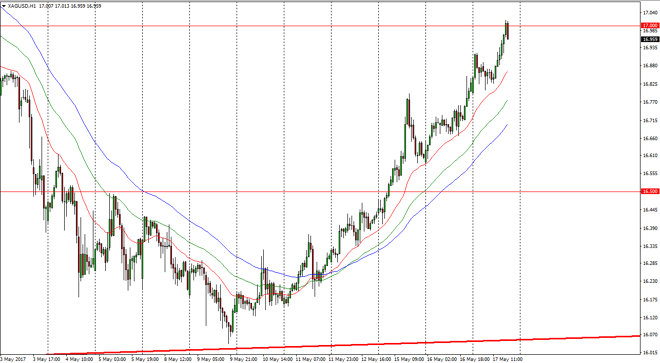

Silver Price Forecast May 18, 2017, Technical Analysis

Updated: May 18, 2017, 04:16 GMT+00:00

Silver markets had a very strong move during the day on Wednesday, as we initially shut higher, pulled back to the open at the day, and then slammed into

Silver markets had a very strong move during the day on Wednesday, as we initially shut higher, pulled back to the open at the day, and then slammed into the $17 level. We found a bit of resistance there, which of course is a large, round, psychologically significant number, and perhaps the market got a bit ahead of itself. A lot of this move would have been due to the panic over President Trump and the Russian speaking, and whatever is going on behind the scenes there. Ultimately, that has nothing to do with the Silver markets, and I believe this automatic reaction will probably fade out.

That being said, a break above to a fresh, new high, of course is a bullish sign. I think the market needs to pull back to find some type of support below. Ultimately, I believe that the Silver markets will follow what happens in the gold markets, and they of course look very bullish.

The other side of the trade

The other side a trade of course is a breakdown below the $16.75 level underneath, and if we get below there I think the market will probably continue to go lower, lease for the short term. The market should continue to be volatile, Silver markets typically are but having said that I believe that the longer-term traders are starting to pick up Silver for value. Futures markets might be a bit choppy and expensive, but CFD markets should be a better way to play because you can cut your position size down enough to deal with that type of volatility. Alternately, options can work as well, and ETFs such as the SLV in the United States which tracks the price of silver and silver related companies.

SILVER Video 18.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement