Advertisement

Advertisement

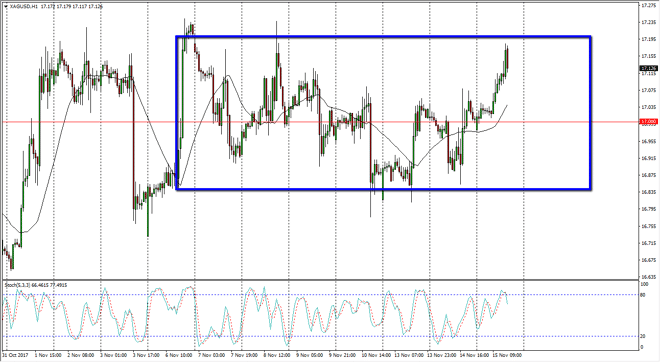

Silver Price Forecast November 16, 2017, Technical Analysis

Updated: Nov 16, 2017, 05:15 GMT+00:00

Silver markets have rallied during the Wednesday session, reaching towards the $17.20 level. We are starting a crossover on the stochastic oscillator in

Silver markets have rallied during the Wednesday session, reaching towards the $17.20 level. We are starting a crossover on the stochastic oscillator in the overbought position on the one-hour chart, and as we have been consolidating so reliably over the last several weeks, I believe it is likely we will see a pullback and a reversion to the mean, which is $17. In general, this is a market that continues to be very noisy and plagued by headlines around the world, and during the last 24 hours or so we have seen the US dollar get decimated, which of course puts upward pressures on the precious metals sector. That being said, I do not think that there’s a longer-term argument for silver, least not until we can clear the $17.50 level, which we are not going to do today more than likely.

In general, we have seen this several times, the market gets a little bit ahead of itself in a little bit excited, and then pulls back. Until proven otherwise, I believe that we are still in consolidation, and at this point I think there is more risk to the downside than, especially if the US Congress puts together some type of tax reform bill, which is most of what is Wayne upon the greenback currently. If they can get that done, this would be an extraordinarily bullish thing for the US dollar in the short term, and that will almost certainly cause precious metals to fall in value. However, until that is finish, not much has changed and in less we see a complete collapse of the greenback, I suspect that we are stuck in this range, and will go looking for $17 rather soon. I would use small positioning in these choppy markets.

SILVER Video 16.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement