Advertisement

Advertisement

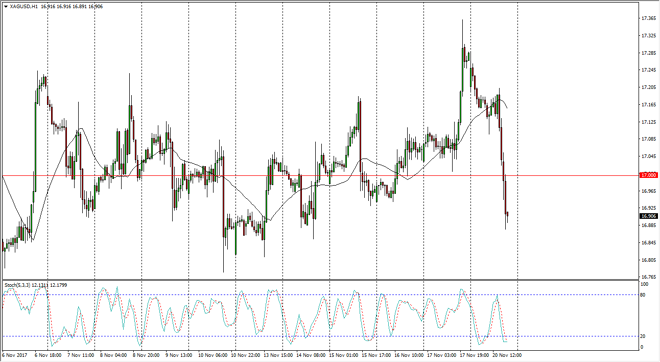

Silver Price Forecast November 21, 2017, Technical Analysis

Updated: Jan 23, 2018, 08:54 GMT+00:00

Silver markets have been very volatile over the last 24 hours, and we have sliced below $17 level during the day on Monday and driven down to the $16.90

Silver markets have been very volatile over the last 24 hours, and we have sliced below $17 level during the day on Monday and driven down to the $16.90 level, which is an area that has been somewhat important. I believe that the market finds even more support near the $16.80 level though, and therefore I’m looking for an opportunity to go long on a hammer or perhaps something like that from short-term charts. The market has been very choppy and sideways for some time, and the $16.80 level underneath has been reasonably reliable. The $17.25 level above is resistance as well, so I think that this market could very well find buyers in the short term.

I’m looking at the stochastic oscillator’s as well, as they are looking to cross in the oversold area. Once we get that cross, and perhaps some type of supportive candle, I am more than willing to start going long, as I believe that it offers a nice short-term opportunity to continue to play this market via CFDs. I don’t think that the market should be one that you want to play in the futures market, because the volatility and the potential losses that can come with a futures contract. Silver isn’t as liquid as gold can be, so you may have trouble getting filled with some type of massive break out or breakdown. The move on Monday has been extraordinarily negative, so be careful, and perhaps scale into a position so that you can take advantage of what has been a very well-defined range. If we were to break down below the $16.80 level, then the market should go to the $16.50 level underneath, which has been supportive on longer-term charts.

SILVER Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement