Advertisement

Advertisement

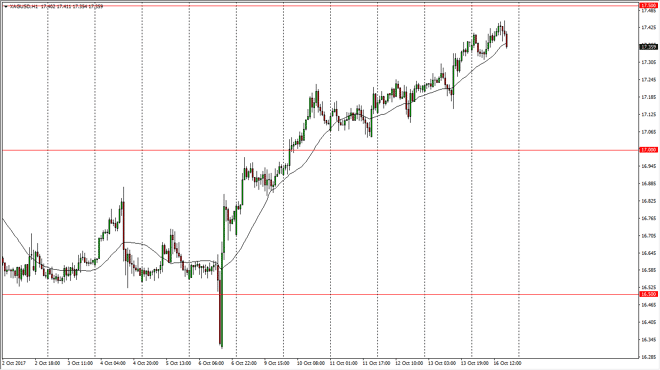

Silver Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:06 GMT+00:00

Silver markets initially dipped during the day on Monday, but found enough support at the 24-hour exponential moving average to turn around and rally

Silver markets initially dipped during the day on Monday, but found enough support at the 24-hour exponential moving average to turn around and rally towards the $17.45 level. Ultimately, we pulled back to reach towards that moving average again, and I think that the market is trying to build up enough momentum to break out above the $17.50 level. I don’t think that will be easy, but it could happen after a couple of the times. I believe that the $17 level underneath is massively supportive, and until we break down below there I think that this remains a “buy on the dips” scenario. Keep in mind that the US dollar of course works in the opposite direction of silver, so if it starts to rally, we could see Silver markets fall.

Don’t forget the safety bid

Sometimes, it’s all about the safety bid. Recently, we have seen both gold and silver rally after the North Korean missile launches, but I think that the overall effect that those launches have is starting to wane. Because of this, I believe that the market is probably going to be more apt to pay attention to the US dollar, but if something else flares up, we could see people running towards precious metals as well. On a break above the $17.50 level, the market should then go looking towards the $18 level after that.

I think you can expect a lot of volatility, because quite frankly that the Silver markets are not as liquid as gold, so you will need to be very careful in general. I suspect that many of you are using the CFD markets, which is probably a good place to be. Futures markets can be very difficult to handle in this market, as your profit and loss statement fluctuates wildly.

SILVER Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement