Advertisement

Advertisement

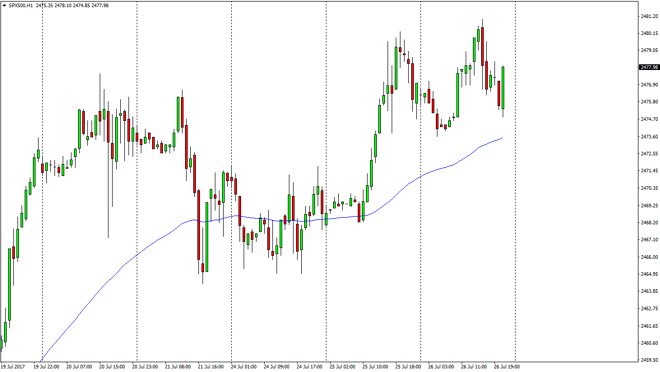

S&P 500 Price Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:42 GMT+00:00

S&P 500 traders initially tried to rally during the day on Wednesday, but then pulled back as we got close to the FOMC statement. In a nutshell, the

S&P 500 traders initially tried to rally during the day on Wednesday, but then pulled back as we got close to the FOMC statement. In a nutshell, the statement said absolutely nothing new, and this seemed to have offered a bit of comfort for traders as we rallied again. It looks as if the market is going to continue the uptrend, and therefore I believe that the market will reach towards the 2500 level yet again. Longer-term, I think we will break above there, but it’s likely that the market will have to pull back several times to build up enough momentum to finally make that move. I think that pullbacks offer value, even from this level.

Buying dips, and most certainly the breakout

With the Federal Reserve looking to tighten monetary policy in a very slow manner, I believe that the S&P 500 will continue to rally over the longer term, and although it might be choppy from time to time, it’s only a matter of time before buyers return. Quite frankly, with an easy money marketplace, it’s likely that stocks in general will continue to do well, and the Federal Reserve is very unlikely to do anything to disrupt the potential of an economic recovery. Job markets are a bit tight, but at the same time it should be noted that inflation is under control. In other words, the market is probably pricing in a sideways economy with a slight uptick, which is fairly accurate as far as the Federal Reserve can see. With this, I remain bullish but I also recognize that it is going to be more of a grind higher than anything else. Selling isn’t a thought, but I certainly think that those pullbacks will present themselves occasionally.

S&P 500 Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement