Advertisement

Advertisement

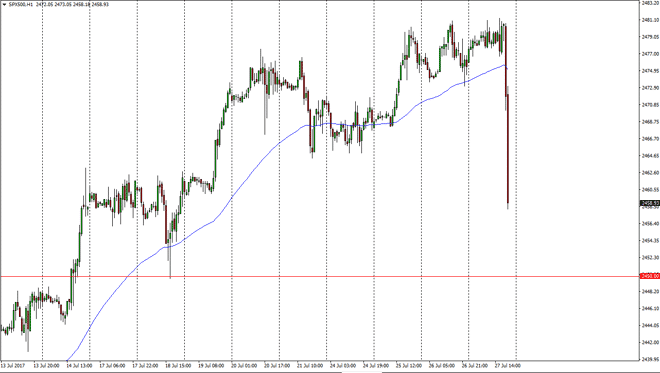

S&P 500 Price Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:57 GMT+00:00

The S&P 500 went sideways during most of the day but then started to pick up volatility as Thursday got further along. I believe that the market

The S&P 500 went sideways during most of the day but then started to pick up volatility as Thursday got further along. I believe that the market underneath at the 2475 handle is showing a bit of support, but right at this point in time I think that we are continuing to see a lot of noise in the market and perhaps it is difficult to hang onto a trade for any length of time. I think short-term trading back and forth is probably as good as it’s going to get. If we can break above the 2500 level, that is a longer-term “buy-and-hold” situation, but we don’t have it yet. If we can break down from here, I think that we will see support below given enough time, so this pullback might be short-lived at best.

Volatility continues

I believe the volatility continues and choppiness of course is a mainstay of the market. It’s probably best to stay away from the S&P 500, but ultimately, I think that there is a lot of noise just waiting to happen. I do favor the upside longer-term, but we may need to pull back to find enough value to start putting money to work. The Federal Reserve looking very quiet and likely to be cautious about tightening suggests that perhaps there are more troubles in the economy than once thought. On the other side of that equation is a lower valued US dollar, and that of course help stocks. Because of this, I think we are seeing a fight between both camps, and until we can get some type of certainty in one direction or another, it’s probably going to be short-term range bound trading at best that you are looking at. Because of this, be very careful.

S&P 500 Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement