Advertisement

Advertisement

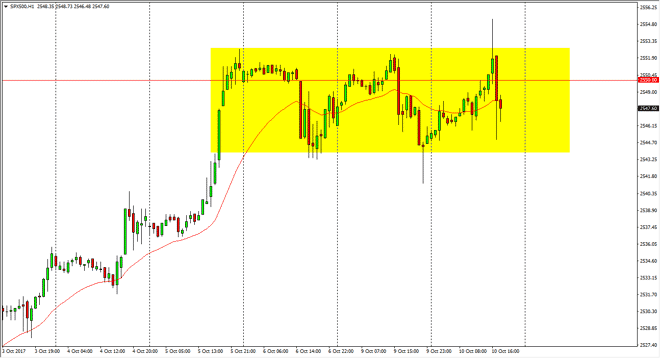

S&P 500 Price Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 07:24 GMT+00:00

The S&P 500 rallied initially during the day on Tuesday, reaching towards the 2550 handle, but then turned around to fall significantly. I think the

The S&P 500 rallied initially during the day on Tuesday, reaching towards the 2550 handle, but then turned around to fall significantly. I think the market is going to continue to go back and forth and the short-term, but longer-term I do like buying the S&P 500 as I believe that the uptrend should continue. Ultimately, the market should go higher, but I think that we are currently trying to build up the momentum necessary to continue to reach towards the upside. I think that the 2540 handle underneath offer support and that the bottom of the overall trend is to be found near the 2500 level. Given enough time, I think that the buyers will be attracted to pullbacks as value, and of course that traders will want to get involved in this market as it has obviously been very bullish as of late.

S&P 500 Video 11.10.17

Until we break down below the 2500 level, I’m not concerned about the overall attitude of the market. I think that we are much more likely to find the 2600 level in the crosshairs sooner than the 2400 level. I also believe that the noise that will almost undoubtedly continue in this market should give buying opportunities to traders longer term. Perhaps we could have short-term pullbacks come into the marketplace to add to our positions slowly, as we gradually build up a larger position. I think that the market continues to offer profits going forward. If we break down below the 2400 level, then the market should break down significantly. Longer-term, I believe that the S&P 500 continues to enjoy money flowing into it, as industrials and financials both are starting to see strength overall, as those sectors are playing catch up with technology previously rallying.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement