Advertisement

Advertisement

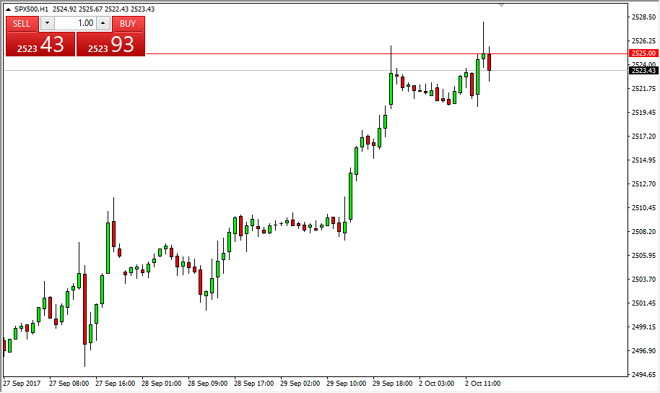

S&P 500 Price Forecast October 3, 2017, Technical Analysis

Updated: Oct 3, 2017, 07:04 GMT+00:00

The S&P 500 had a reasonably quiet session on Monday as we continue to tread water just below the 5.5 handle. We did try to break it really in the

The S&P 500 had a reasonably quiet session on Monday as we continue to tread water just below the 5.5 handle. We did try to break it really in the trading session but found sellers above that level. It is perhaps a market that is a bit overextended currently, so pullbacks would probably be building momentum to the upside. I think this is a good thing for the overall health of the market, but clearly, we are in an uptrend in selling is a very difficult thing to do. I think that given enough time, we should go looking towards the 2550 handle, especially considering how much bullish pressure we had seen late on Friday. The market typically will find those types of signals coming into the marketplace when larger funds are starting to buy again.

S&P 500 Video 03.10.17

I believe that the 2500 level below will be supportive, and offer a bit of a “floor” in the market. I also believe the stock markets, in general, continue to find buyers, as there has been so much in the way of bullish pressure around the world. The S&P 500 has been leading the other US indices as of late, as the markets have rolled out of technology and into larger multinational corporations, with the lone exception being the Russell 2000, which of course measures the strength of smaller companies. Given enough time, I think we go looking towards the 2550 level, and then eventually 2600. The S&P 500 is still very much in an uptrend, and continues to be a “buy the dips” market. I think that the fourth quarter of the year should be rather strong, as it has a certain amount of bullish seasonality to it anyway. The Santa Claus rally is coming soon.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement