Advertisement

Advertisement

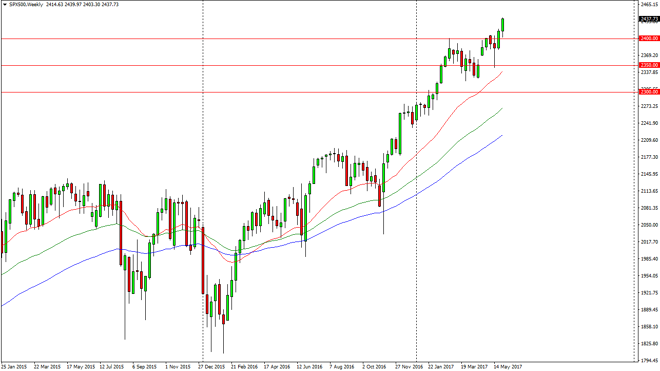

S&P 500 Price Forecast for the Week of June 5, 2017, Technical Analysis

Updated: Jun 4, 2017, 07:09 GMT+00:00

The S&P 500 initially fell during the week but found enough support at the 2400 level to bounce significantly and show it strength. I believe that the

The S&P 500 initially fell during the week but found enough support at the 2400 level to bounce significantly and show it strength. I believe that the market now is going to go to the 2450 handle, and then eventually the 2500 level. The market seems to have a bit of a floor at the 2400 level, so I believe it’s only a matter of time before the markets find buyers on every dip we get. Longer-term traders are going to continue to favor the upside, and I believe that it will continue to be that way. The market certainly seems to be strengthened after the recent consolidation, which is exactly what you want to see in an uptrend.

Buying dips every time they calm

I believe it’s a simple as buying dips every time this market does that. I would be really surprised to see this market break down below the 2400 level, and even if we did I suspect that there would be plenty of support on the way down to the 2350 handle after that. Given enough time, we will not only test the 2500 level, but I think we will break above there. The markets are a bit strong and a bit overdone in general, but the fact that we have gone back and forth over the last several weeks to build up more momentum tells me that the next leg just started. Most pundits believe in the strength of the market, and that in and of itself will drive the market higher as more volume enters. Some valuations are a bit high and the S&P 500, but ultimately all you can do is follow the market and do as it tells you to do. Right now, it’s telling you to buy.

S&P 500 Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement