Advertisement

Advertisement

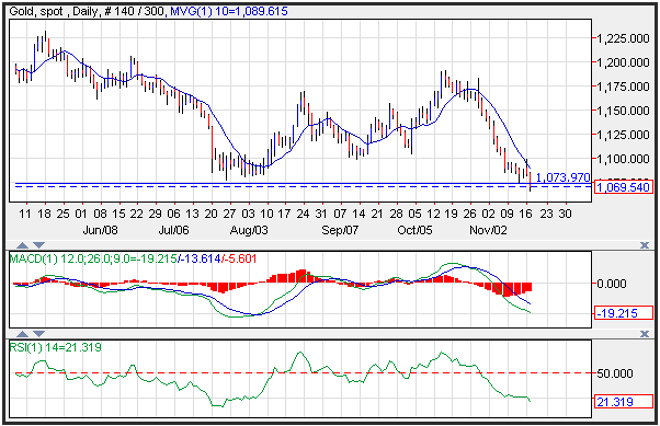

Technical Analysis Gold for November 18, 2015

By:

Gold prices broke down through trend line support, as a stronger dollar eroded the price of the yellow metal. Since gold is priced in dollars, as the

Gold prices broke down through trend line support, as a stronger dollar eroded the price of the yellow metal. Since gold is priced in dollars, as the dollar climbs, it undermines the price of gold in countries outside of the United States. A solid CPI number help buoy U.S. yields which gave the greenback a boost on Tuesday. Gold prices broke through horizontal trend line support at 1,073, and could be poised to test the weekly lows at 1018. The RSI, on the other hand, is printing a reading of 21, well below the oversold trigger level of 30, which could foreshadow a correction.

The October overall-CPI was 0.2% in line with expectations, while the core index was 0.2%.Year over year growth rose to 0.2 from flat in September, and the core y/y growth rate was steady from 1.9%.Energy prices grew 0.3%, with a 0.4% gasoline price decrease.Food prices were 0.1%, after 0.4% in September.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement