Advertisement

Advertisement

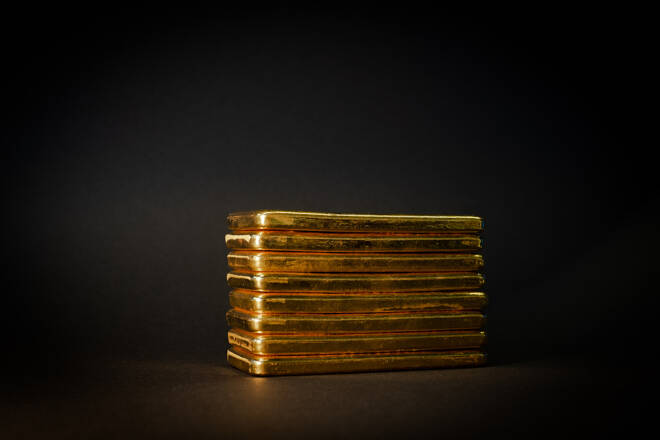

The Dollar is Weaker, Yields Are Lower and Gold Still Declines

By:

It will be interesting to see if Friday’s jobs report adds to the possibility that the recent price decline in gold is nearing a tentative completion.

The Dollar’s Decline, Bond Trends, and Gold’s Unwavering Slide: A Detailed Analysis

The dollar is now in its second consecutive day of trading to lower values. The same is true for the U.S. 10-year and 30-year Bonds. However, this has not halted the recent and strong price decline seen in gold. The precious yellow metal has now had 9 consecutive days of lower closes. Gold has also traded to a lower high for the last 11 trading days along with nine consecutive trading days of lower lows.

Market Uncertainty Grows Over Federal Reserve’s ‘Higher for Longer’ Strategy

It is obvious that market participants are still concerned about the Federal Reserve and its current campaign of “higher for longer.”

According to the CME’s FedWatch tool, there is only a 19.6% probability that the Federal Reserve will raise its benchmark rate at the November FOMC meeting. The probability that the Federal Reserve will implement one last rate hike this year by ¼% in December is now 29.4%, with an additional 3.2% probability that the Fed will raise rates by ½% in December.

This means that the concern by market participants is not focused on whether or not the Fed will raise rates one more time this year but rather on how long they will remain elevated. Also, the announcement at the September FOMC meeting that the Federal Reserve is now planning to reduce rates next year by a ½% by cutting rates by ¼% twice. This is a large contraction from the June projection which indicated that the Fed was anticipating cutting rates by a full percentage point in 2024.

A Technical Look at Gold Futures

On a technical basis, there is no major support for the December contract of gold futures until $1815. This is based upon a double bottom that occurred at the end of February and the beginning of March.

It also appears that a death cross is imminent. Currently, the 50-day simple moving average is just above the longer-term 200-day simple moving average.

While multiple Western technical indicators have concluded that gold pricing is oversold, there is an Eastern technical exhaustion pattern and a Western technical exhaustion indicator that also confirms that gold might be extremely oversold and could find tentative support. The Eastern technical pattern is called an 8 to 10 new price low. As the name suggests this pattern occurs when a stock or commodity has declined in price for 8 to 10 trading sessions. This pattern suggests that after eight new session lows or price declines that market is now in an oversold scenario suggesting a potential reversal.

A prominent Western market technician Tom DeMark has created a unique methodology used in market timing to uncover potential inflection points. According to his website, “Every investor knows that markets rarely move linearly. Each trend contains advances and pullbacks, driven by news, events, fundamentals, technicals, order flow, sentiment and emotion. Market timing seeks to navigate the risks and the opportunities these variables create.”

He has labeled his method as Sequential ®, which he defines as “a multiphase indicator that analyzes price data to provide insight into the inherent strength or weakness of the market’s trend and its likelihood of reversing.”

One of his primary indicators is simply labeled “9 ®”. He explains this sequential pattern using the number nine in the following way. “A 9 indication marks a completion of the Setup phase in the Sequential and Combo family of indicators. The 9 output looks for a series of consecutive price comparisons to define the underlying environment. Generally speaking, these 9 results are often followed by a price reversal, with the impact and duration defined by other elements of the indicator.”

It will be interesting to see if Friday’s jobs report adds to the possibility that the recent price decline in gold is nearing a tentative completion.

As of 3:45 PM EDT, the most active December contract of gold futures is down $0.80 or 0.04% and fixed at $1834.10

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement