Advertisement

Advertisement

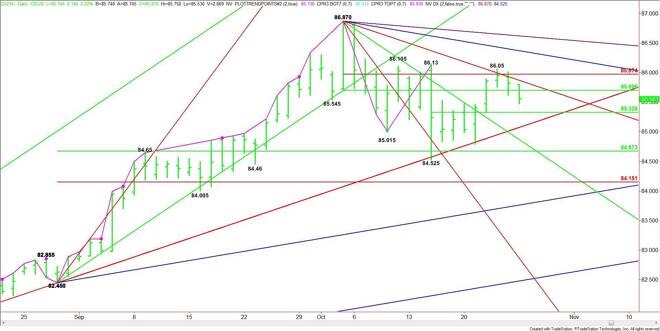

US Dollar Index (DX) Futures Technical Analysis – October 28, 2014 Forecast

By:

December U.S. Dollar Index futures weakened for a second day after reaching a near-term high at 86.05 late last week. The close near the low gives the

December U.S. Dollar Index futures weakened for a second day after reaching a near-term high at 86.05 late last week. The close near the low gives the market a slight downside bias on the opening today.

The main range is 86.87 to 84.525. Its retracement zone at 85.70 to 85.97 stopped the rally last week and is providing resistance today.

A downtrending angle from the contract high passes through this zone at 85.81 today, making it a valid upside target.

The short-term range is 86.13 to 84.525. Its pivot at 85.33 is the next likely downside target, followed by a long-term uptrending angle at 85.14.

Crossing 85.81 will be the first sign of strength today, but don’t expect an acceleration to the upside unless 85.97 is taken out with conviction. If this occurs then look for tests of 86.05, 86.13 and 86.34.

The first downside target today is 85.33, followed by 85.81. Watch for an acceleration to the downside if the long-term angle at 85.81 fails as support. The daily chart indicates there is plenty of room to the downside with 84.67 the best target over the near-term.

The tone of the market today will be determined by trader reaction to 85.70.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement