Advertisement

Advertisement

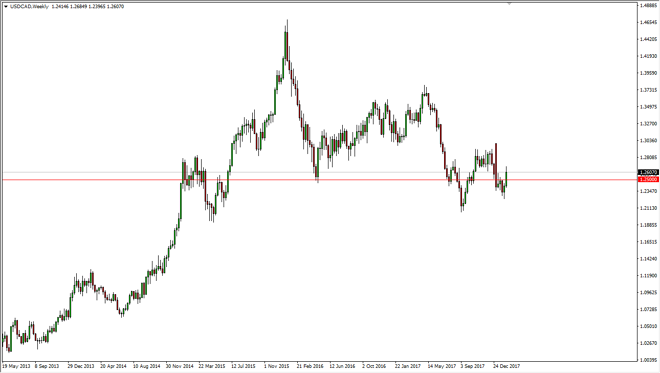

USD/CAD Price forecast for the week of February 12, 2018, Technical Analysis

Updated: Feb 10, 2018, 06:03 GMT+00:00

The US dollar has rallied against the Canadian dollar, breaking above the 1.25 level during the week, and even stretching above the 1.26 level in reaction to poor employment numbers coming out of the Great White North.

The US dollar has rallied against most currencies around the world, and the Canadian dollar was in any different. With falling oil prices, it makes sense that this pair would rally. Remember, the Canadian dollar is used as a proxy for the oil markets by most currency traders, so therefore if WTI Crude Oil falls, typically the Loonie will as well. As we in the week, it looks as if the US dollar is trying to make some type of stand and could continue the bullish pressure. This will be especially true if the oil markets continue to look as soft as they have.

An abysmal employment number coming out on Friday in Canada did not help things as well. Ultimately, interest rates are rising in the United States, and that is typically good for the currency. Because of this, I think we will continue to see buying pressure, but I also recognize that the exact opposite could be true, and I would consider it so if we broke down below the hammer from the previous week. This is essentially a breakdown below the 1.22 handle. Recently, we have seen a lot of short-term volatility in this pair, which quite frankly is the norm as the 2 economies are so intertwined. Remember, Canada and the United States are each other’s largest trading partners, so sometimes these currencies can grind against each other more than anything else. I believe that we are at a crucial inflection point, so keep your position size small and then add as the market proves itself.

USD/CAD Video 12.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement