Advertisement

Advertisement

USD/JPY Price Forecast February 23, 2018, Technical Analysis

Updated: Feb 23, 2018, 04:53 GMT+00:00

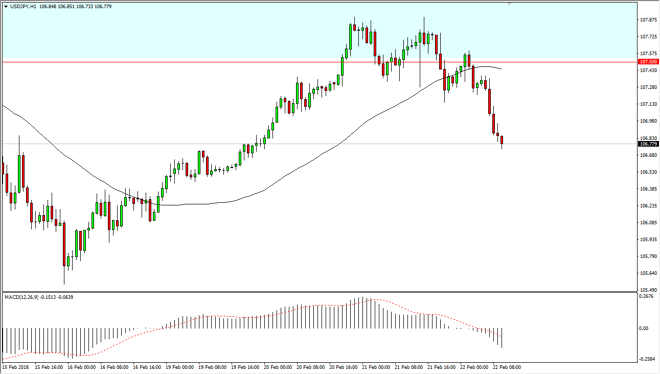

The US dollar has fallen a bit during the trading session against the Japanese yen, reaching as low as 106.50. However, on the hourly chart we are starting to see a bit of support come back into the market, so we could get a bit of a bounce. I like the idea of buying at a lower level, but I would do so with a small position.

The US dollar has fallen again against the Japanese yen, but on the hourly chart looks as if it is trying to form a bit of a bounce. While a bit early to get excited, I think we are starting to get a nice opportunity to start going long, perhaps reaching towards the 107.50 level, perhaps even higher than that. If we can clear to make a fresh, new high, then this recent pullback has been just that: a recent pullback. That offers value the traders will be willing to take advantage of, and it should be mentioned that the hammer that formed on the hourly chart is based upon the 50% Fibonacci retracement level. Because of this, we could get value hunters coming back into the market, especially if we start to see the US dollar strength in overall, something that certainly looks possible.

Alternately, if we break down below the 106.50 level, the market probably drops down to the 105.50 level, which would wipe out the entire move higher. This is a market that continues to be noisy, and of course has a lot of correlations risk appetite around the world, so pay attention the stock markets as well. This market typically moves in concert with those over the longer term, please don’t forget that. Either way, be quick to protect your position and move stop losses to breakeven.

USD/JPY Video 23.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement