Advertisement

Advertisement

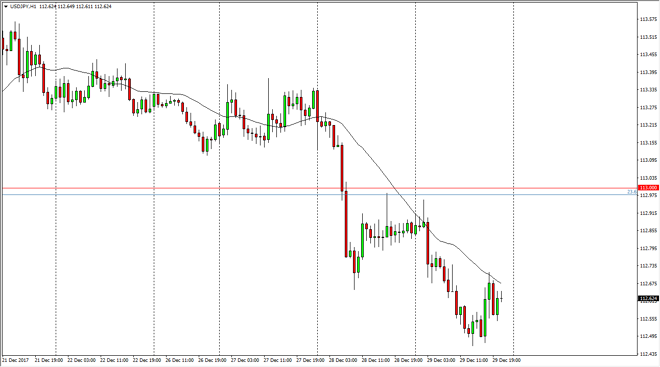

USD/JPY Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:14 GMT+00:00

The US dollar fell against most currencies around the world on Friday, and the Japanese yen was no different. We reached as low as the 112.50 level before bouncing, but of course there was very little in the way of volume during the day.

The US dollar fell against the Japanese yen during the Friday trading session, reaching down towards the 112.50 level underneath. That’s an area that caused a bit of a supportive bounce, but on low-volume so I don’t think it’s difficult to trade this market with confidence. When you look at the longer-term charts, we are essentially in a significant consolidation area, so I think if we were to break above the 113 handle, that would be a very bullish sign and I would be willing to jump into the market at that point. Otherwise, I suspect that as soon as we get some type of resistance and exhaustive action, the sellers will probably jump back in and trying to push the market down to the 112 level.

I believe that there will be a lot of volatility, and with the jobs number coming out later this week, it’s likely that this pair will be quiet until then. This pair is highly sensitive to those announcements though, so keep that in mind as we are more than likely going to see a lot of choppiness between now and then, and then eventually a move in congruence with the jobs announcement. The better the jazz announcement, the better this pair tends to do. That’s because it’s a “risk on” type of move in the pair is to the upside, and coincides nicely with the stock markets. With a lack of volume, I would read too much and what we are seeing right now and I believe that it’s only a matter of time before we get some type of jump.

USD/JPY Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement