Advertisement

Advertisement

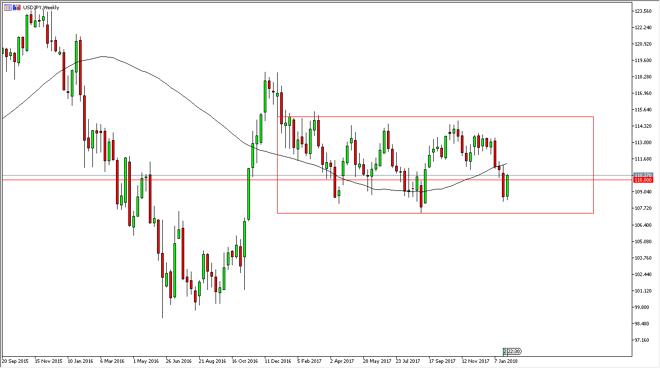

USD/JPY Price forecast for the week of February 5, 2018, Technical Analysis

Updated: Feb 3, 2018, 05:51 GMT+00:00

The US dollar has rallied significantly during the week, breaking above the 110 level on Friday which of course was a reaction to the strong jobs number.

The US dollar has bounced hard during the Friday session, breaking above the 110 level, and showing signs of strength yet again. The volatility will continue to be extreme in this market, but that’s nothing new. When you look at the weekly chart, you can clearly make out a large rectangle, so it’s obviously likely to continue that move. If we break down below the 107.50 level, that would destroy the consolidation, and it could send the markets much lower levels, at least the 105 level. If we break out to the upside, it’s likely that we would go to the 114 level over the longer term, perhaps reaching towards the 115 level after that. A break above the 115 level sends this market much higher, perhaps the 122 with significant resistance at the 118 handle.

I believe that pullbacks offer value, so longer-term traders may look to short-term charts to pick up new positions. I believe that the very green candle looks strong, and the fact that the last couple of candles have looked this way suggests that we are forming a two-week hammer. That is a very bullish sign, and at this point I am willing to not only by this position but add on to this position on short-term pullbacks. I believe that the market should continue to be noisy, but profitable for those who can ride out this type of volatility. Remember, the S&P 500 quite often will lead the USD/JPY pair going forward, and if the market broke out to the upside over there, it should continue to push this pair higher.

USD/JPY Video 05.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement