Advertisement

Advertisement

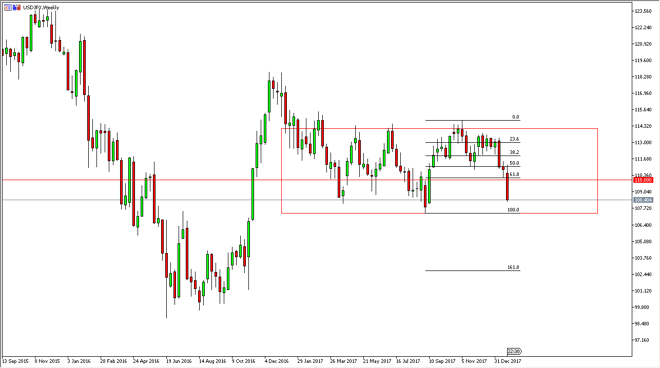

USD/JPY Price forecast for the week of January 29, 2018, Technical Analysis

Updated: Jan 27, 2018, 05:45 GMT+00:00

The US dollar rallied initially during the week but ran into trouble again and broke down significantly against the Japanese yen. A large portion of the losses were on Friday, as the Bank of Japan is suggesting that the Japanese economy should continue to strengthen.

The US dollar has initially tried to rally during the week, but ran into enough trouble at the 111 region to fall significantly. We broke below the 110 handle, and more importantly the 61.8% Fibonacci retracement level from the recent rally. I think that the market will probably continue down to wipe out the overall move, meaning that we will be going to the 107.50 level. The markets continue to be very noisy, and I think that it will continue to be very difficult to navigate. However, the market should continue to be attracted to the 107.50 level underneath, which would be a complete rollover of the move. In fact, I have no interest whatsoever in trying to buy this market until we break above the 110 handle, which would take a significant amount of momentum.

If we do break above the 110 handle, I think the market could rally back to the top of the overall consolidation, but I would not expect miracles. Otherwise, the market breaking down below the 107.50 level should send this market down to at least the 105 level, if not the 161.8% Fibonacci retracement level, closer to the 103 level. That would be catastrophic for the US dollar, but right now it certainly looks as if the sellers are becoming very aggressive. We are starting to see the US dollar selloff against most currencies, so this action in this pair should be much of surprised if you’ve been following the Aussie, Euro, or even the Pound.

USD/JPY Video 29.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement