Advertisement

Advertisement

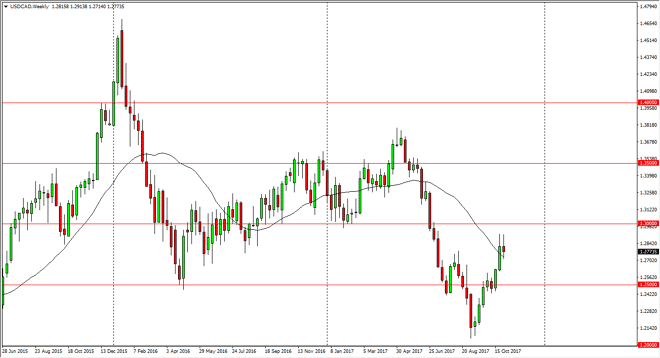

USD/CAD Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:12 GMT+00:00

The US dollar had originally tried to rally during the week against the Canadian dollar, but found the 1.29 level to be a bit resistive. I think there is

The US dollar had originally tried to rally during the week against the Canadian dollar, but found the 1.29 level to be a bit resistive. I think there is a bit of a resistance “zone” between there and the 1.30 level. This was exacerbated by the employment figures mess on Friday coming out of the United States, and then as a result we saw the market roll over a bit. I suspect that there is still an opportunity to make support below, but I think shorter-term we may find this market drifting down to the 1.25 handle. Alternately, if we were to break above the 1.30 level on a daily close, I think longer-term “buy-and-hold” traders would come back into play.

Never forget that oil has its influenced as well, but quite frankly the Canadian dollar has not reacted positively to rallying oil markets. As of late, the market to been paying more attention to the bond markets and interest rate differential in those bond markets than the crude oil market. Overall, the volatility will continue because these 2 markets continue to be so intertwined, and of course the market had recently sold off. The 1.20 level underneath is massively supportive, as it is the bottom of the selloff after the bond trade that had people buying the Loonie. I believe that given enough time though, we will see some type of clarity. Right now, I think it’s a bit difficult to get a handle on the longer-term trend, so I think that short-term traders will probably continue to be the best way to play this market. If we did break above the 1.30 level though, I might be a little bit more inclined to hang on to a position.

USD/CAD Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement