Advertisement

Advertisement

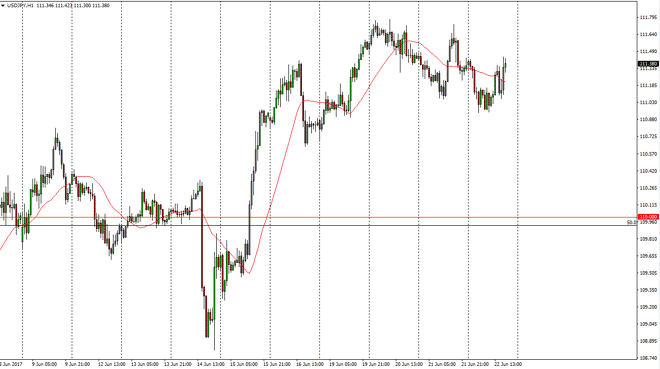

USD/JPY Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:41 GMT+00:00

The USD/JPY pair fell a bit during the day on Thursday, but found enough support near the 111-level underneath to bounce and show signs of life. The

The USD/JPY pair fell a bit during the day on Thursday, but found enough support near the 111-level underneath to bounce and show signs of life. The market looks likely to go looking for the 112-level given enough time, but it of course will be very choppy as this market is volatile in general. I believe that the Federal Reserve raising interest rates over the longer term will of course keep this market positive, and it is risk sensitive. Being rest sensitive, the market should react in congruence with the stock markets and futures markets. I believe that the longer-term outlook for this market of course is bullish, but nonetheless I think that the 114 and the 115 level will both be targeted.

Buying pullbacks

I believe that buying pullbacks will be the way to play this market, and since we broke above the top of a weekly hammer, I believe that the buyers are starting to flex their muscles. It may take some time to get there, but I have a target of 114 over the next several weeks. I believe that the “floor” in this market is the 110 level, and it’s not until we break down below there that I would be concerned. This is a market that continues to find plenty of buyers underneath, and although volatile, has been consistent in its bullish pressure over the last couple of weeks. Ultimately, this is a market that shakes a lot of traders out, but ultimately this is a market that does tend to trend longer-term on interest rate differentials and of course the difference between how Bonser trading in the United States and Japan. Currently, it seems as if interest rate differential will start to favor the Americans even more.

USD/JPY Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement