Advertisement

Advertisement

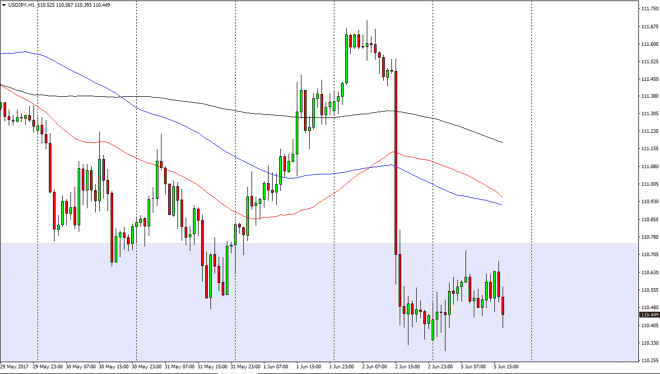

USD/JPY Forecast June 6, 2017, Technical Analysis

Updated: Jun 6, 2017, 05:57 GMT+00:00

The USD/JPY pair had a choppy session on Monday, as we rallied towards the 110.75 level, but found that area resistive a couple of times. Currently, it

The USD/JPY pair had a choppy session on Monday, as we rallied towards the 110.75 level, but found that area resistive a couple of times. Currently, it looks as if the market is trying to consolidate, which typically means continuation of the larger move. You can see that we fell apart during Friday’s trading, so will be interesting to see if we do go lower. However, I recognize that the 110-level underneath is important when it comes to longer-term charts, and of course the fact that it is the 50% Fibonacci retracement level on the longer-term move helps as well. So, it’s possible that we could break out to the upside, and if we break above the 110.75 level, the market should then rally all the way to the 111.50 level above which is where the meltdown started from.

But if we break down…

If we do breakdown below the 110 level, I believe that the market will then go looking for the 61.8% Fibonacci retracement level below. That of course is another area where you see a lot of trading, and it just happens to coincide with the 108 level, which is a large, round, psychologically significant number as well. Although I do favor the upside longer-term, I am aware of the fact that the market could breakdown in the short term, which of course is the market offering even more value as far as I can see. Shorter-term trades of course will present themselves to the downside if we do breakout, but we believe that the market will be one that you should be somewhat careful as I believe there is a lot of underlined bullish pressure, but having said that you can see that we have a couple of different opportunities depending on what happens next.

USD/JPY Video 06.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement