Advertisement

Advertisement

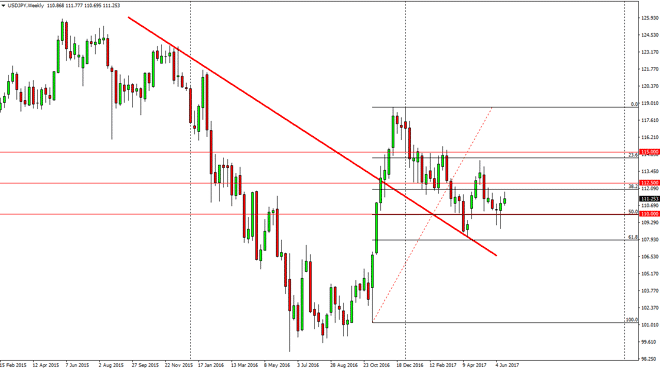

USD/JPY forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:15 GMT+00:00

The US dollar rallied during the week, breaking above the top of the hammer from the previous week. That’s a very bullish sign, especially considering

The US dollar rallied during the week, breaking above the top of the hammer from the previous week. That’s a very bullish sign, especially considering that the hammer formed on the 50% Fibonacci retracement level. A break above the top of the candle for the week should send this market towards the 112.50 level. If we can break above there, the market should then go to the 114 handle. The market looks very likely to be volatile, but I believe that the most recent low being higher than the previous one is a very bullish sign, and the fact that the hammer is sitting right at the gap also gives me reason to think that the buyers are to get involved. On top of that, we have the 110 handle it that region, so I believe that no matter what happens, the buyers will return to this market.

Risk sensitivity

The markets are very sensitive to risk, but I think longer-term what we are seeing is a return to the bullish attitude of the market, as we had a massive impulsive move late in the previous year, and now I think we are trying to attract more money into this market. I believe that we will go looking towards the high that we recently had, at the 119 handle. It will be very difficult and choppy, but for the longer-term investor, this market should continue to be very bullish. I have noticed in shorting, least not until we break down below the 61.8% Fibonacci retracement level which of course is the 108 handle. If you are patient enough, you should make money in this pair to the upside but it is going to be very noisy to say the least.

USD/JPY Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement