Advertisement

Advertisement

Brexit and COVID-19 Keep the Pound in the Spotlight, with U.S Politics also in Focus

By:

It's a relatively quiet day ahead on the economic calendar, leaving geopolitics and COVID-19 in focus on the day.

Earlier in the Day:

It’s was a relatively quiet start to the day on the economic calendar this morning. The Aussie Dollar was in action early on, with economic data from Japan due out later this morning.

For the Aussie Dollar

Consumer sentiment was in focus early on. The Westpac Consumer Sentiment Index jumped by 11.9% to 105.0 in October. In September, the Index had surged by 18.0% to 93.8.

According to the latest Westpac Report,

- A 2nd sharp monthly rise took the index to its highest level since July 2018. Confidence now sits 10% above the average level in the 6-months prior to the pandemic.

- The sharp increase was attributed to the October Federal Budget and continued success in containing the COVID-19 outbreak.

- Expectations of a further RBA rate cut in November was also considered a possible source of support.

Looking at the sub-indexes:

- Finances vs a year ago rose by 6.2% to 92.9, with finances next 12-months rising by 9.4% to 110.8.

- Sentiment towards the economic outlook continued to impress.

- Economic conditions next 12-months surged by 24.2% to 94.0, taking it above the long-run average of 90.7.

- Over the next 5-years, sentiment jumped by 14.1% to 113.8. The long-run average sat at 91.3.

- The time to buy a dwelling sub-index rose by 10.6%, with the Unemployment Expectations Index sliding by 14.2%.

- Sentiment towards the housing sector also improved, with the House Price Expectations Index surging by 31.5%.

The Aussie Dollar moved from $0.71623 to $0.71644 upon release of the figures. At the time of writing, the Aussie Dollar was up by 0.04% to $0.7164.

For the Japanese Yen

Finalized industrial production figures for August are due out later this morning. Barring a marked revision from prelim numbers, however, the data should have a muted impact on the Yen.

At the time of writing, the Japanese Yen was up by 0.13% ¥105.34 against the U.S Dollar.

Elsewhere

At the time of writing, the Kiwi Dollar was up by 0.11% to $0.6658.

The Day Ahead:

For the EUR

It’s a relatively busy day ahead on the economic calendar. Key stats include August’s industrial production figures for the Eurozone.

Finalized inflation figures for Spain are also due out but will likely have a muted impact on the EUR.

On the monetary policy front, ECB President Lagarde is scheduled to speak. Expect any chatter on monetary policy or the economic outlook to influence.

With Boris Johnson’s 15th October Brexit deadline, however, expect the focus to be on Brexit ahead of tomorrow’s EU Summit.

Adding to the EUR’s near-term woes is the continued rise in new COVID-19 cases.

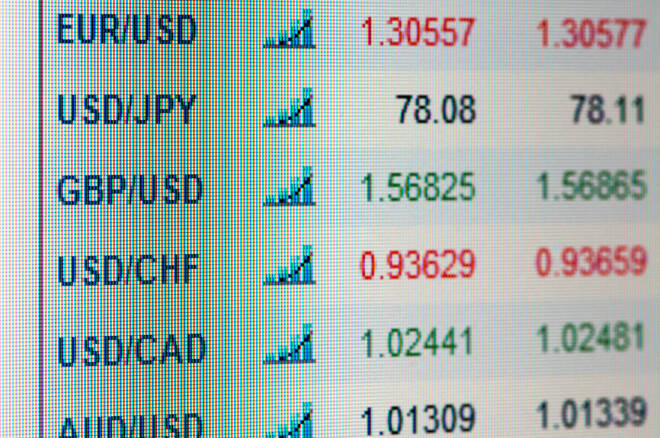

At the time of writing, the EUR was down by 0.03% to $1.1743.

For the Pound

It’s a quiet day ahead on the economic calendar. There are no material stats due out, leaving the Pound in the hands of Brexit.

Its last chance saloon for the likes of Macron to compromise or face the uncertainty of a no-deal Brexit. Hopes of an EU compromise and an agreement had hit a wall over the weekend following Macron’s latest demands.

With the BoE ready to deliver negative rates and the UK government introducing new COVID-19 containment measures, only a Brexit deal can support a Pound rebound.

At the time of writing, the Pound was down by 0.05% to $1.2931.

Across the Pond

It’s a relatively busy day ahead for the U.S Dollar. September wholesale inflation figures are due out later today.

Barring particularly dire numbers, however, the stats are unlikely to have a material impact on the U.S Dollar.

The market focus will likely remain on geopolitics, Capitol Hill, the U.S Presidential Election, and COVID-19 updates.

The Dollar Spot Index was up by 0.01% to 93.539 at the time of writing.

For the Loonie

It’s a quiet day ahead, with no material stats to provide the Loonie with direction.

While there are no material stats, the IEA’s monthly report should provide crude oil prices along with the weekly inventory numbers.

Expect COVID-19 news to also influence sentiment towards the demand for crude oil and the direction of the Loonie.

At the time of writing, the Loonie was down by 0.08% to C$1.3150 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement