Advertisement

Advertisement

Economic Data, Geopolitics, and U.S Stimulus Progress in Focus

By:

Economic data, COVID-19 news, geopolitics, and fiscal stimulus chatter will keep the markets busy in the day ahead.

Earlier in the Day:

It’s a quiet start to the day on the economic calendar. There are no material stats to provide the markets with direction in the early part of the day.

A lack of stats will leave the markets to consider rising tensions between the U.S and China. Progress towards a COVID-19 vaccine and U.S fiscal stimulus talks also need consideration.

Looking at the latest coronavirus numbers

According to figures at the time of writing, the number of new coronavirus cases rose by 221,985 to 15,313,437 on Wednesday. On Tuesday, the number of new cases had risen by 240,565. The daily increase was lower than Tuesday’s rise and 242,529 new cases from the previous Wednesday.

Germany, Italy, and Spain reported 2,214 new cases on Wednesday, which was up from 1,889 new cases on Tuesday. On the previous Wednesday, 1,523 new cases had been reported. Spain was the main contributor to the uptick in new cases for a 3rd consecutive day.

From the U.S, the total number of cases rose by 48,152 to 4,076,721 on Wednesday. On Tuesday, the total number of cases had increased by 67,140. On Wednesday, 22nd July, a total of 71,670 new cases had been reported.

Majors

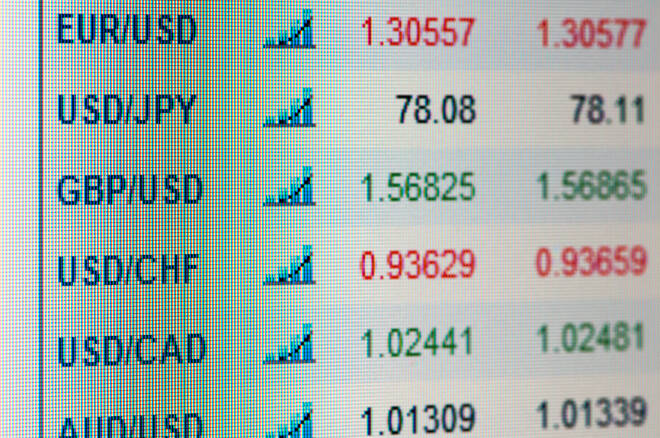

At the time of writing, the Japanese Yen was down by 0.01% to ¥107.16 against the U.S Dollar. The Kiwi Dollar was down by 0.05% to $0.6659, with the Aussie Dollar down by 0.03% to $0.7138.

The Day Ahead:

For the EUR

It’s a relatively busy day ahead on the economic calendar. Key stats include Germany’s GfK Consumer Climate figures for August and the Eurozone’s consumer confidence figures for July.

Consumer confidence is key to the economic recovery within the region. While any weakness would be EUR negative, progress with the EU Recovery Fund should ease any market angst.

From the U.S, rising tensions between the U.S and China and fiscal stimulus also need consideration on the day.

At the time of writing, the EUR was flat at $1.1570.

For the Pound

It’s a relatively quiet day ahead on the economic calendar. CBI industrial trend order figures for July are due out later today.

While the figures will influence, Brexit and trade negotiations with key trading partners will continue to remain the key drivers.

At the time of writing, the Pound was up by 0.01% to $1.2735.

Across the Pond

It’s a relatively quiet day ahead for the U.S Dollar. The weekly jobless claims figures are due out later today.

Following a 1.3m jump in the week ending 10th July, the markets will be looking for a sub-1m rise in claims. With the 2nd wave hitting the U.S, however, any jump from the previous 1.3m will test market risk sentiment.

Away from the numbers, rising tension between the U.S and China, fiscal stimulus, and COVID-19 vaccine news influence.

On Wednesday, the Dollar Spot Index fell by 0.14% to 94.988, with fiscal stimulus talk easing demand for the Greenback.

For the Loonie

It’s a quiet day ahead on the economic calendar. Following a relatively busy start to the week, there are no major stats due out of Canada later today.

A lack of stats will leave the Loonie in the hands of market risk appetite and crude oil prices.

At the time of writing, the Loonie was up by 0.02% to C$1.3414 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement