Advertisement

Advertisement

Global Markets Are Mixed, FOMC Decision At Hand, U.S. Housing Data Gives Big Surprise

By:

Global markets are mixed while traders wait on the latest FOMC rate decision. Stronger than expected housing starts and building permits data does not bode well for the Doves.

The U.S. Futures Are Down In Early Trading

The U.S. futures are down in early Wednesday trading while market participants wait on the latest FOMC rate decision. The tech-heavy NASDAQ Composite is in the lead with a loss of -0.25% but the Dow Jones and S&P 500 are close behind. The FOMC is expected to cut rates by 25 bps but the outlook has deteriorated from recent lows. The odds of a single cut at this meeting are a mere 58% showing a massive retreat from the 100% odds priced in just a few weeks ago. Looking out to the end of the year the odds for three more cuts are virtually non-existent, the odds for two more cuts only 40%.

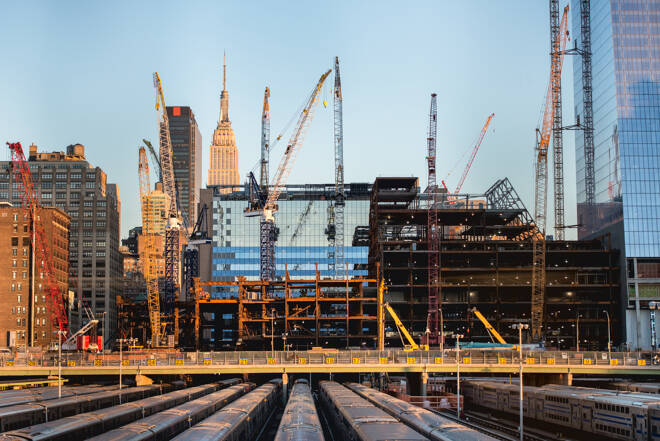

In economic news, today’s Housing Starts and Building Permits data was spectacular. The number of housing starts jumped by 12% month to month and 6% YOY while permits advanced a strong 7.5%. The surge of new building will help fuel an already strong labor economy and lead to higher wages and consumer spending. This data does not support the need for FOMC rate cuts.

In stock news, shares of General Mills are down about -0.60% after reporting better than expected earnings. The company says revenue was a bit weak but EPS was strong due to solid gains in the U.S. Shares of FedEx are down nearly -11.0% after the company reported weak results and poor guidance. Fedex says the slowing global economy is hurting the macro-environment in which it operates. Adobe also reported better than expected results coupled with weak guidance. Shares of that stock are down nearly -3.0%.

EU Markets Are Edging Higher

Indices in the EU are edging higher in early Wednesday trading. The market is hopeful the FOMC will support the U.S. economy but there are risks. The U.S. data is strong and does not support the idea of aggressive rate-cutting despite slowing global macro conditions. The CAC is in the lead at midday with a gain near 0.20%, the DAX and FTSE are close behind.

In economic news, UK CPI came in weaker than expected and at a 3-year low. The news sent the pound lower because it confirms the need for BOE easing. In stock news, shares of Moncler are down -5.0%. The luxury retailer says unrest in Hong Kong is hurting the market. In political news, Jean-Paul Juncker says the UK is on track for a hard-Brexit.

Asian Markets Are Mixed

Asian markets are mixed at the end of the Wednesday trading session. The biggest move was made by the Korean Kospi and still less than 0.50%. the Nikkei, Shanghai and Hang Seng all closed within 0.25% of flat line albeit on differing sides. Traders in the region are watching a number of events with today’s FOMC meeting topping the list. In stock news, AB Inbev is moving forward with a second attempt at spinning off its Asian arm. The company hopes to raise $6.6 billion.

About the Author

Thomas Hughesauthor

Thomas has been a professional options trader and investor since October 2005. At that time, Thomas was introduced to financial markets, technical analysis, and financial market analysis. He tracks economic data from the worlds leading economies, corporate earnings, equities, currency, commodities, and cryptocurrencies.

Advertisement