Advertisement

Advertisement

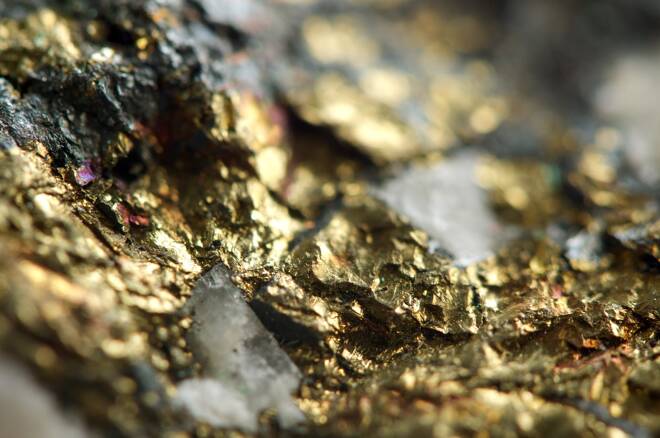

Gold Recovers The Upside Amid Political And Economic News

Published: Apr 30, 2019, 12:43 GMT+00:00

Gold and silver advanced against the US Dollar amid political and economic concerns. However, the metals are losing steam.

Gold is trading positive on Tuesday as investors are digesting weak economic data in China, but good enough in Europe. And political developments in Venezuela and the abdication of Emperor Akihito in Japan.

The dollar index, on the other side, is posting losses for the third day in a row and equities are mixed ahead of a new round of corporate reports.

Silver is also positive on the day, but it remains in its range, while Copper is recovering the 2.9000 area again after posting gains for the third day, and Platinum is testing the 900.00 resistance.

China economic data disappoints

Caixin Manufacturing PMI dropped to 50.2 points in Abril from 50.8 in March, an unexpected decline against the improvement of the PMI to 51.0 expected by the market.

Non-manufacturing PMI data declined to 54.3 points in April from 54.8 reported in March. Despite that all number above 50 signal expansions, the data was below expectations of 54.5, so the growth was slower than expected.

The NBS manufacturing PMI also declined to 50.1 in China through April. Below the expectations and March number of 50.5.

Data in China is fueling concerns amid the global economy.

On the other hand, the GDP in the eurozone rose 0.4% in the first quarter of 2019 and advanced 1.2% in interannual terms between the first quarter of 2018 and 2019.

CPI in Germany also gave some excellent information as it rose 2.1% YoY in April.

Venezuela at the edge of confrontation

Juan Guaido, Venezuelan Asamblea Nacional president and named interim president of the country called the army to overthrow President Nicolas Maduro. He also released Leopoldo López, opposition leader in jail, and called the people to take the street.

Oil prices rose on Tuesday amid the Venezuelan crisis, fueling gold and other precious metals to go up too.

WTI oil is trading at 64.40 on Tuesday, 1.30% positive on the day; while Brent barrel is advancing 0.75% on the day at 71.50.

Gold recovers almost all Monday losses

Gold is trading positive on Tuesday as the pair is taking advantage of some risk aversion amid economic data in China and the situation in Venezuela. The dollar index is trading down, so it is a clear path for the XAU/USD to pot more gains.

As James Hyerczyk, FX Empire analyst, affirmed in a recent article, “a weaker U.S. Dollar could also be underpinning gold; however, gains are likely being limited by rising U.S. Treasury yields and stronger-than-expected Euro-Zone economic data.”

XAU/USD is now trading 0.40% positive on the day at 1,285, recovering almost all the losses suffered on Monday and testing the 20-day moving average level at 1,286.

However, INTL FCStone analyst Edward Meir believes the current rally in gold will be short-lived. “We do not recommend establishing length at current levels on gold, given the lack of upside drivers.”

“Although the dollar is not moving higher on the back of strong macro readings, it is not coming down either; neither are the U.S. long-term rates,” Meir added.

In the case XAU/USD retakes the downside, it will find next support at 1,280. Then 1,266 and finally the 200-day moving average at 1,250.

To the upside, the pair needs a close above the 1,290 area first and then a break above the 1,300 level to make bulls believe.

Silver bounces, but it’s losing steam

Silver is trading positive on Tuesday amid risk aversion on the market. However, the unit is losing steam in the American session.

XAU/USD is currently trading at 14.93, 0.18% positive on the day after recovering from 14.88 on Monday to test the 15.00 area and failing it.

The unit remains inside the range that has been trading in the last two weeks between 14.90 and 15.10.

About the Author

Mauricio Carrilloauthor

Mauricio is a financial journalist with over ten years of experience in stocks, forex, commodities, and cryptocurrencies. He has a B.A and M.A in Journalism and studies in Economics by the Autonomous University of Barcelona. While traveling around the world, Mauricio has developed several technology projects focused on finances and communications. He is the inventor of the FXStreet Currency Poll Sentiment index tool.

Advertisement