Advertisement

Advertisement

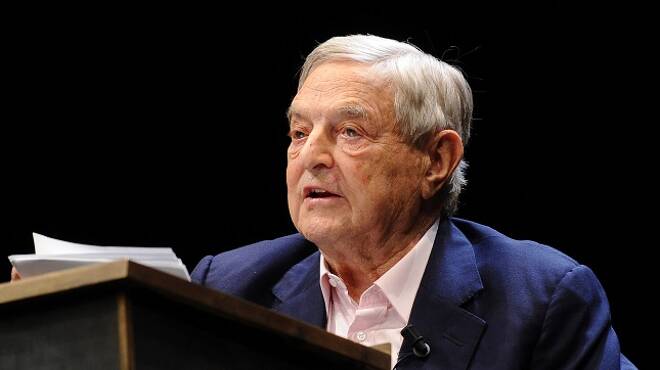

It’ not a Bubble, George Soros Plans to Invest in Cryptocurrencies

By:

Did George Soros just deliver the Cryptomarket with a rally that could revive talks of a Bitcoin move to $40,000 by the end of the year and possibly more?

George Soros is well known for his influence on the financial markets, Soros has made a name for himself when he took the Bank of England to the cleaners on Black Wednesday back in the early 90’s, Soros pocketing a cool billion in the process, placing him at the top of the list of the world’s greatest currency speculators.

Earlier in the year, Soros had in fact labeled cryptocurrencies as a bubble, adding that Bitcoin couldn’t be labeled as a currency due to its inability to store value, the comments in line with other bigwigs of the financial world, include JPMorgan Chase CEO Jamie Dimon.

The negative comments from Soros coincided with the cryptomarket’s meltdown in late December that saw Bitcoin fall from an all-time high $19,891 to February’s sub-$6,000 low.

Perhaps Bitcoin’s more than 30% fall following the comments gave Soros the belief that, in spite of seeing cryptocurrencies as a bubble with no value to assign, the possible influence on direction was reason enough to begin trading in the virtual currency.

The timing of Soros’s comments at Davos and the slide may have been coincidental, with government and regulator chatter on the need to introduce regulations into the cryptomarket having already begun to influence the cryptomarkets back in late December, with Bitcoin having already fallen 43% ahead of Soros’s speech, but the moves in the last week may have seen more influence from the billionaire financier.

News began to hit the wires on Friday, 6th April of Soros’s plan to begin investing in cryptocurrencies, with Soros also having recently approved the trading of cryptocurrencies at family office Soros Fund Management that has $26bn in assets under management.

Bitcoin has moved from 6th April’s $6,500.2 to $8,129.2 at the time of writing, a 25% gain and the rally has come despite the markets continued fear over the regulatory outlook, the rise in regulatory risk has been the primary driver to the bearish trend in the 1st quarter.

So, is the latest news and the approval for Soros Fund Management to begin investing into cryptocurrencies coming from a new found love of Bitcoin and the broader market? The negative comments in January and an about turn in just a matter of months points to another Soros market manipulation and why not, Soros having earned his stripes to impact the global financial markets all those years ago, long before Satoshi’s vision in the wake of the global financial crisis.

Soros is not alone and the anticipated inflow of family office money is yet another reason for the crypto bulls to be licking their lips. As for a bubble, if Soros is in, everyone’s in and that’s no bubble.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement