Advertisement

Advertisement

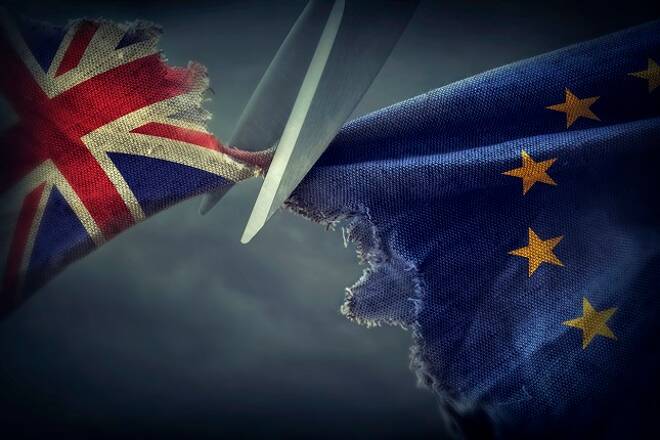

The Week Ahead – Brexit, U.S Politics, COVID-19, and a Busy Economic Calendar in Focus

By:

It's a particularly busy week ahead. While economic data will influence, Brexit, COVID-19, and U.S politics will be in the driving seat.

On the Macro

It’s a particularly busy week ahead on the economic calendar, with 65 stats in focus in the week ending 30th October. In the week prior, 56 stats had been in focus.

For the Dollar:

It’s a busy week ahead on the economic data front.

On Tuesday, durable goods orders, core durable goods, and consumer confidence figures are in focus.

The focus will then shift to 3rd quarter GDP numbers and the weekly jobless claims figures on Thursday.

At the end of the week, September’s inflation and personal spending figures are due out.

Other stats in the week include trade data, housing sector figures. Chicago’s PMI, and finalized consumer sentiment figures for October. These stats are unlikely to have a material impact on the Dollar and market risk sentiment.

Away from the economic calendar, it’s less than 2-weeks before the U.S Presidential Election and Senate Elections. There is also the extended negotiations on Capitol Hill to continue monitoring.

The Dollar Spot Index ended the week down by 0.98% to 92.768.

For the EUR:

It’s also a busy week ahead on the economic data front.

On Monday, Germany’s Ifo Business Climate Index and sub-indexes will provide direction.

The focus will then shift to Germany’s unemployment numbers for October on Thursday.

At the end of the week, 3rd quarter GDP numbers, consumer confidence, and retail sales figures wrap things up.

Throughout the week, prelim inflation figures for France, Germany, Italy, and the Eurozone are also due out. With market concerns over deflationary pressures, any further fall in prices will test support for the EUR.

On the monetary policy front, the ECB is in action on Thursday. While the markets are not anticipating a move, the fresh spike in new COVID-19 cases may force the ECB to promise further support. Expect Lagarde to call on Brussels and EU member states for more action.

Away from the economic calendar, COVID-19 numbers will also influence. More stringent lockdown measures will test the EUR.

The EUR/USD ended the week up by 1.21% to $1.1860.

For the Pound:

It’s a particularly quiet week ahead on the economic calendar.

There are no material stats due out of the UK to provide the Pound with direction.

The lack of stats will leave the Pound in the hands of COVID-19 and Brexit. With more containment measures in place, the Pound could come under pressure ahead of November’s monetary policy decision.

Near-term, the only upside for the Pound would come from a Brexit deal. News from the weekend was hopeful of a deal.

The GBP/USD ended the week up by 0.97% to $1.3040.

For the Loonie:

It’s a relatively busy week ahead on the economic calendar.

Economic data includes building permits and RMPI figures for September and August GDP figures.

Expect the GDP figures to have the greatest influence on the data front.

Of greater significance in the week, however, is the Bank of Canada’s interest rate decision on Wednesday.

While the markets are expecting the BoC to leave policy unchanged, the latest spike in new COVID-19 cases could force a more dovish tone.

The Loonie ended the week up by 0.49% to C$1.3125 against the U.S Dollar.

Out of Asia

For the Aussie Dollar:

It’s a relatively quiet week ahead on the economic calendar.

3rd quarter inflation and wholesale inflation figures are due out on Wednesday and Friday. Business confidence figures are also due out on Thursday.

Expect the numbers to garner plenty of interest, as chatter builds over a possible move by the RBA.

From elsewhere, 3rd quarter GDP numbers from the U.S and EU member states will also influence.

Away from the economic calendar, COVID-19 figures and U.S politics will also provide direction in the week.

The Aussie Dollar ended the week up by 0.82% to $0.7139.

For the Kiwi Dollar:

It’s a relatively quiet week ahead on the economic calendar.

September trade data and October business confidence figures are due out in the week.

Expect Kiwi Dollar sensitivity to the numbers.

The Kiwi Dollar ended the week up by 1.35% to $0.6691.

For the Japanese Yen:

It is a relatively quiet week on the economic calendar.

September retail sales and industrial production figures are due out in the week, along with October inflation figures.

We don’t expect too much influence from the numbers, however, with U.S politics in focus in the week.

Expect any continued rise in COVID-19 cases to also influence.

On the monetary policy front, the Bank of Japan is in action on Thursday. Will the BoJ hold back a little longer or deliver further monetary policy support?

The Japanese Yen ended the week up by 0.65% to ¥104.71 against the U.S Dollar.

Out of China

It’s a particularly quiet week ahead on the economic data front.

There are no material stats due out to influence riskier assets in the week.

The lack of stats will leave geopolitics in focus.

The Chinese Yuan ended the week up by 0.16% to CNY6.6868 against the U.S Dollar.

Geo-Politics

UK Politics:

With October coming to a rapid end, the markets will be looking for progress towards a Brexit deal.

News from the weekend was positive, though there was also chatter of Boris Johnson wanting to hold out until after the U.S Presidential Election.

From the EU, news reports suggest that there may be a greater incentive to reach an agreement. Media reports of Macron being willing to soften his hardline on access to UK Fisheries should support the Pound.

U.S Politics

Blue wave or a Donald Trump comeback? It’s the final week of October and the polls still have Biden out ahead…

Expect plenty of chatter in the week, with the markets likely to take an even greater interest in the polls.

Looking at the 8 swing states, Biden still holds a lead in 6, suggesting a Democrat victory on 3rd November.

While election fever will heat up in the week, any further updates from Capitol Hill on stimulus talks will also influence in the week ahead.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement