Advertisement

Advertisement

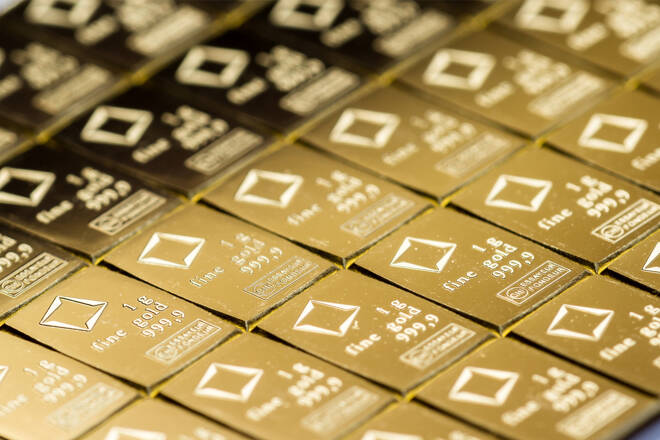

Will Gold Skyrocket After CPI Report?

By:

CPI data will have a big impact on gold price dynamics. In the longer term, central bank purchases will stay the key driver for gold markets.

Key Insights

- Gold is trading near the $2000 level ahead of the important U.S. inflation reports.

- Lower inflation will provide Fed with an opportunity to start cutting rates, which will be bullish for gold markets.

- Central bank purchases amid growing geopolitical tensions will likely remain the key driver for gold markets in the longer term.

All Eyes On CPI Data

On April 12, U.S. will release inflation data for March. Analysts expect that Inflation Rate will decline from 6% to 5.2%, while Core Inflation Rate will increase from 5.5% to 5.6%.

While Fed’s favorite measure of inflation is the Core PCE Index, inflation reports have a significant impact on gold markets.

At this point, traders expect that Fed will raise the federal funds rate by 25 bps at the next meeting in May. The market believes that this hike will be Fed’s last hike as the central bank has already put significant pressure on the economy. Thus, the Fed is expected to start cutting rates in 2023.

The interest rate is an important catalyst for gold markets as gold pays no interest. Higher interest rates are usually bearish for gold. In case Inflation Rate falls towards 5.00%, gold will get additional support and may quickly test all-time high levels.

Central Bank Purchases Will Remain The Key Driver For Gold Markets In The Longer Term

Gold managed to get closer to all-time high levels despite rising interest rates. It looks that central bank purchases were the key driver behind this move.

Central banks are buying gold to diversify their reserves. Diversification has become increasingly important amid rising geopolitical tensions. As sanctions became the norm in international relations, central banks want to increase their exposure to a physical asset that cannot be blocked or frozen.

For example, China cut U.S. Treasury holdings to the lowest level since the global financial crisis while boosting its gold reserves. Most likely, the fear of financial sanctions amid worsening U.S. – China relations was the main driver for this move. Traders should closely monitor central bank holdings to see whether they continue to buy gold at a robust pace as such purchases may soon push gold to new highs.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement