Advertisement

Advertisement

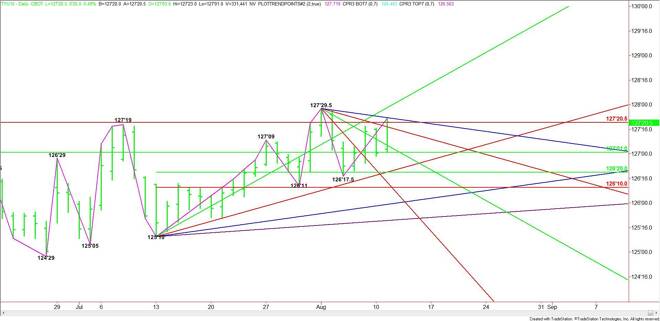

10-Yr U.S. Treasury Notes (TY) Futures Technical Analysis – August 11, 2015 Forecast

By:

September 10-Year U.S. Treasury Notes reversed course during the pre-market session after closing near the low on Monday. The strong recovery has put the

September 10-Year U.S. Treasury Notes reversed course during the pre-market session after closing near the low on Monday. The strong recovery has put the market in a position to challenge last week’s swing top at 127’29.5. A trade through this price will signal a resumption of the uptrend.

The first upside target today is an uptrending angle at 127’30. Crossing to the bullish side of this angle will put the market in a bullish position with the next likely targets 129’19 and 129’31. These prices are not likely to be tested, however, unless the Fed takes a 2016 rate hike off the table.

Based on the current price at 127’20.5, the first resistance is a major Fibonacci level at 127’20.5. This is followed by a downtrending angle at 127’23.5.

On the downside, the first target is a downtrending angle at 127’17.5. The daily chart opens up to the downside under this level with the next target another downtrending angle at 127’05.5 and a major 50% level at 127’01.

The 50% level at 127’01 is also a trigger point for a steep sell-off with the next target a support cluster at 126’20.

The direction of the market the rest of the session is likely to be determined by trader reaction to the major Fibonacci level at 127’20.5.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement