Advertisement

Advertisement

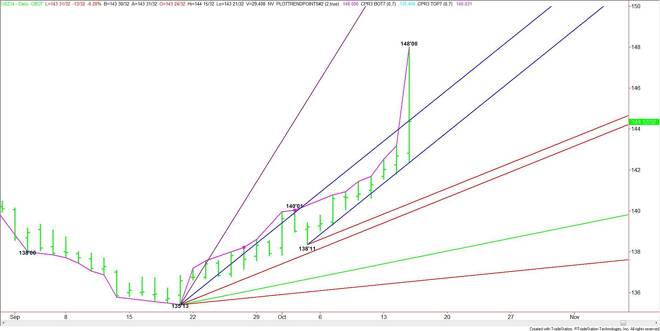

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – October 16, 2014 Forecast

By:

Panic buying and short-covering spiked the December 30-Year U.S. Treasury Bonds to a new all-time high on Wednesday. The move took the futures contract to

The break back to 144’12 put the market back inside the steep up channel that has been guiding the market higher for several weeks. The upper level of the channel comes in at 144’29 today while the lower level of the channel moves up to 142’27.

Crossing to the strong side of the uptrending angle at 144’29 will put T-Bonds in a strong position once again. Taking out the lower uptrending angle at 142’27 could encourage further selling pressure.

The daily chart opens up under 142’27 with a pair of angles at 140’19 and 140’05 the next potential downside targets.

Look for selling pressure today if stocks mount a strong recovery. The bullishness will continue, however, if stocks continue to sell off and if U.S. economic reports continue to come out weaker than expected.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement