Advertisement

Advertisement

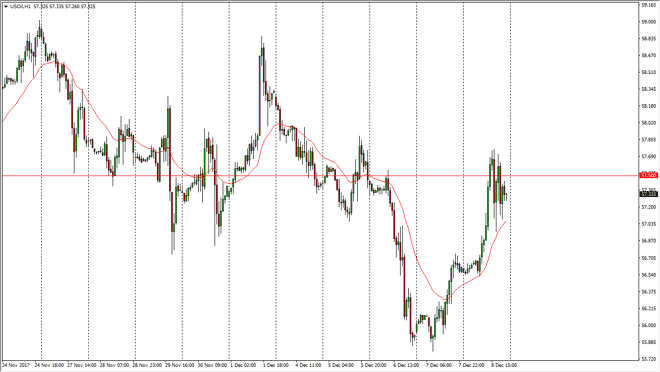

Crude Oil Price Forecast December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:03 GMT+00:00

Crude oil markets continue to be very volatile, but Friday was bullish indeed, as the buyers returned.

WTI Crude Oil

The WTI Crude Oil market initially went sideways during the Friday session, but then broke towards the $57.50 level, as it has been resistance in the past, which of course showed itself to be so during the day. I believe that the market is essentially trying to figure out where to go next, so waiting for an impulsive move in one direction or the other, is reason enough to start trading in that same direction. I think that we will continue to see volatility due to the OPEC production cuts, but at the same time a slowing demand out of the United States and of course the flooding of the market at higher valuations by the Americans, Canadians, and of course Mexicans.

Crude Oil Inventories Video 11.12.17

Brent

Brent markets also rally during the day, reaching towards the $63.50 level. I think that the resistance is much more stringent near the $64 handle, so we will probably try to get to that level. Short-term pullbacks will probably be a buying opportunity, but if we were to break down below the $62.50 level, then I think the market could roll over significantly. At that point, I would anticipate that we are going to go back down to the $61 level. If we can break above the $64 level, the market should then go to the $65 level after that. That is an area that is important from a large, round, psychologically important standpoint, and of course an area where Americans will be flooding the market. I think the volatility continues, and a range bound trading opportunity should present itself every few days in this market between now and the end of the year.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement